Are you interested in an environment where new challenges arise by the nanosecond?

Find your next role at Optiver

Careers

Recruitment news

-

Experienced, Life at Optiver Machine learning opportunities in capital markets

Solving problems at scale The allure of “problems at scale” is significant for researchers aspiring to transition from academia to the private sector. At Optiver, we are constantly scaling up in every dimension – adding more features, models, financial exchanges on which we trade; and expanding our range of products, asset classes and geographic colocations. […]

Learn more -

Life at Optiver Insight to action: The world of equity analysts at a market maker

Investment acumen meets instinct In the ever-evolving world of the capital markets, the role of Equity Analyst stands out as a goal for those with a penchant for curiosity, analysis and investment acumen. The position is not just coveted for its intellectual rigor and the pivotal role it plays in investment decisions. Essentially, it provides […]

Learn more -

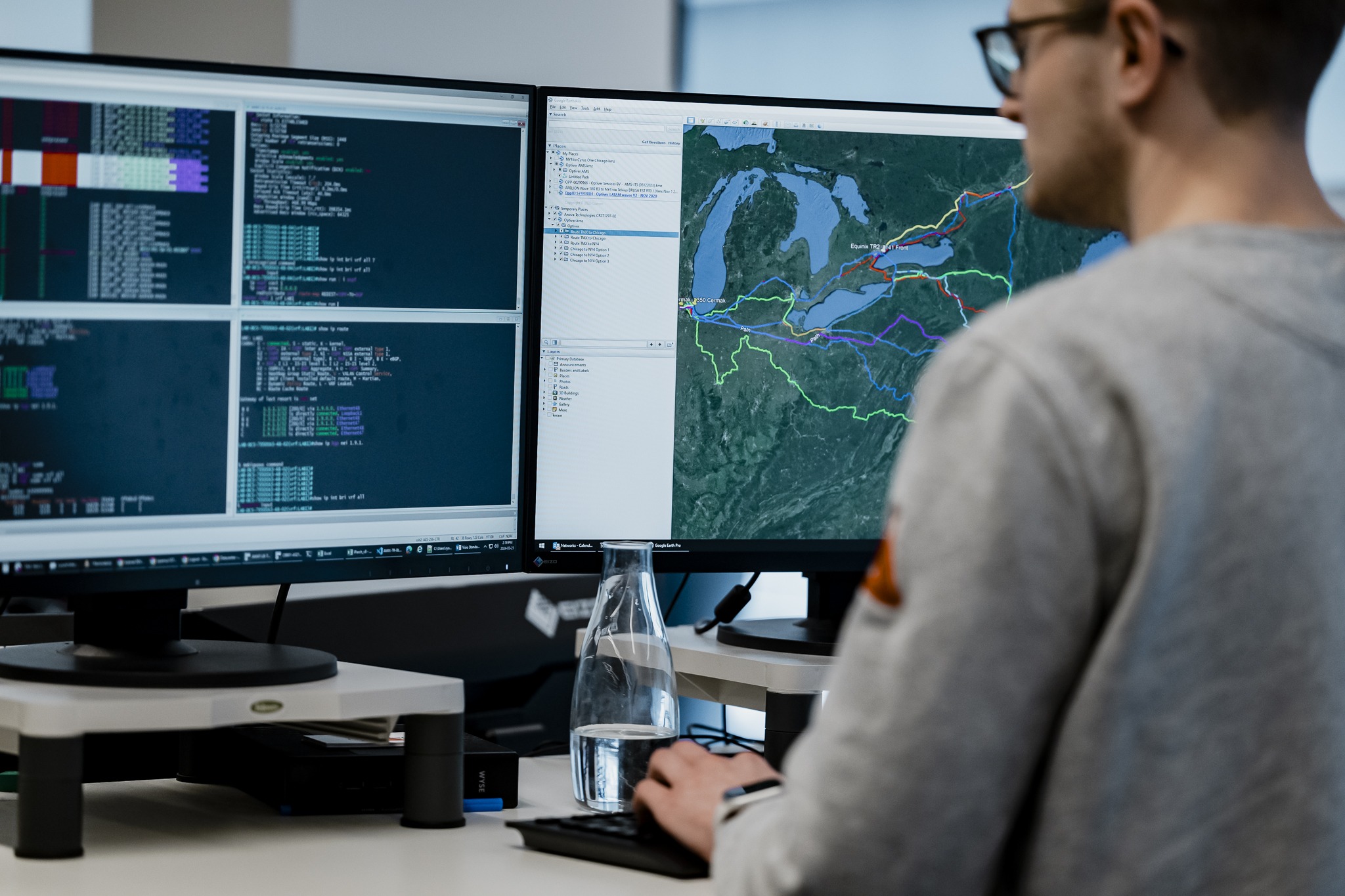

Experienced, Life at Optiver, Technology Behind the scenes: Engineering Optiver’s global trading network

Optiver’s global trading network is a marvel of engineering, ensuring rapid and reliable data transmission essential for electronic trading. Network Engineer Ryan Bennett reveals how dedicated fibre optic cables and meticulous route planning maintain Optiver’s competitive edge. Despite challenges like geographical hurdles and fibre cuts, the network’s resilience and continuous improvement keep Optiver at the forefront of trading innovation.

Learn more -

Meet the team Charley Pincombe’s journey from history major to Global Head of Procurement at Optiver

Charley Pincombe, Optiver’s Chicago-based Global Head of Procurement, didn’t always know she was going to work in the tech space. A former history major, Charley started her career in the public sector and quickly came to love the tech-focused subject matter of her day-to-day role. Charley found her perfect match at Optiver, where she blends her operational expertise and passion for innovation in an environment that mirrors the agility and spirit of a startup.

Learn more -

Meet the team From Mathematical Olympiads to Optiver: Ana’s Journey

Ana’s transition from participating in prestigious Mathematical Olympiads to the fast-paced trading floors of Optiver is a remarkable tale of passion meeting profession. With a strong foundation in Computer Science and an innate love for solving puzzles, Ana found herself in the world of finance, a field she hadn’t originally considered. Her involvement in various Mathematical Olympiads, including as a contestant and later as a team and organiser, not only demonstrates her commitment to the discipline but also highlights her role in mentoring young women in STEM. In this post we’ll explore Ana’s journey, offering a closer look at how her background in mathematics has shaped her career in trading, the challenges she’s navigated, and her advice for aspiring young women in these fields.

Learn more -

Experienced, Meet the team A finance role unlike others

As a leading proprietary trading firm, Optiver works to make markets more efficient, transparent and stable across the globe. While our commitment to provide liquidity is continuous and our aim is to be a stabilising force, financial markets and our operations are dynamic. For the Finance Team, this requires continuous improvements in finance processes to stay aligned with evolving market conditions and business strategies.

Learn more -

Recruitment at Optiver APAC Internship and Graduate FAQs

Get answers to frequently asked questions about Optiver’s graduate and internship programs.

Learn more -

Meet the team, Recruitment at Optiver Meet the Sydney Campus Recruitment team

We know how daunting it can be – applying for your first job. So, we’re here to help make your application process easier.

Learn more -

Competition, Experienced Advent of Code 2023: Clean Code Challenge

In December last year, Optiver proudly entered its third year as a sponsor of Advent of Code. This annual event, structured like an advent calendar, offers tech enthusiasts from around the world the chance to test and showcase their creative programming skills with a new festive-themed puzzle each day. Our sponsorship reinforces our commitment to fostering technical innovation and a culture of continuous learning.

Learn more -

Experienced, Life at Optiver Risk and reward within a dynamic trading firm: Insights from Optiver’s CRO Europe

In business, risk management is often thought of as a of back-office support function—the department generally responsible for steering a company away from pitfalls and worse-case scenarios with cautionary, arms-length advice. Not at Optiver. In our high-stakes trading firm environment, it’s a core discipline that directly impacts the success of daily trading operations. As Optiver […]

Learn more