Risk and reward within a dynamic trading firm: Insights from Optiver’s CRO Europe

In business, risk management is often thought of as a of back-office support function—the department generally responsible for steering a company away from pitfalls and worse-case scenarios with cautionary, arms-length advice. Not at Optiver. In our high-stakes trading firm environment, it’s a core discipline that directly impacts the success of daily trading operations.

As Optiver Europe’s Chief Risk Officer (CRO), I’d like to bring you inside the distinct challenges and rewards of risk management that are specific to our environment.

My journey at Optiver

As a university student 10 years ago, I participated in an event co-sponsored by Optiver: the Traders Trophy, one of 13 national competitions that culminated in a worldwide final where students and recent grads took part in a high-tech stock-trading simulation, diving into the world of international stock exchanges, profits and risks. That engaging look into trading and financial markets sparked my interest in Optiver early on.

I joined Optiver as Junior Risk Analyst, was later promoted to Head of Market Risk, and then to my current role of CRO. As Optiver also supports office transfers, I got to spend some time working in our Chicago office along the way—an invaluable professional experience.

The big picture

The pivotal role of Optiver’s Risk team in navigating the intricacies of our business means every day is interesting, and every day is different. Whereas traders focus on their particular trading desk, Risk gets to take a helicopter view, looking in more detail at the total risk picture of all trading desks combined—and even more broadly at the risk profile of the organisation as a whole. Having this broader overview allows you to bring in different perspectives to challenge the trading positions and setup accordingly.

Understanding the trading risk landscape

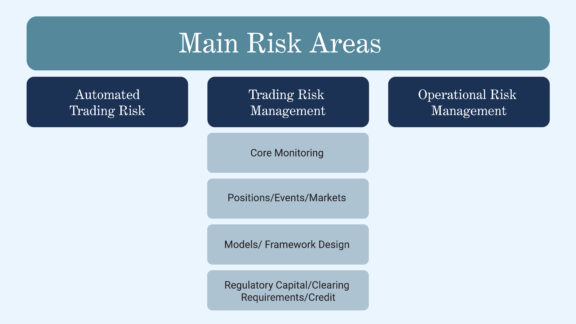

There are various risks inherent to trading—they come with the business. Since managing the risks linked to Optiver’s operations is a fairly broad task, we distill them into three main risk areas as the infographic below illustrates: Trading Risk Management (TRM), Automated Trading Risk (ATR), and Operational Risk Management (ORM). I’d like to focus here specifically on TRM, and the key role they play in our successful daily trading operations.

TRM focus on four main pillars. Via automated tooling, they manage the first pillar: Core monitoring to cover the daily risk management of the trading book, with adherence to the limit framework that’s tied to our capital and funding requirements. But even more importantly, TRM discuss the firm’s positions with Trading to provide input regarding the different opportunities and risks that they observe.

Under the pillar of Position, Markets and Events, TRM review the economic calendar in more detail with Trading, to anticipate any potential consequences. Additionally they actively discuss specific events that may occur, in order to assess together any pricing and position impact.Within the Modelling and Framework pillar, Risk works closely together with Research on assessing the impact of pricing model updates on the risk model, and how any change in methodologies could assist both Trading and Risk to draw a better risk profile and further improve decision-making.

The Regulatory capital pillar has taken a more prominent role over the years, consciously evaluating whether the risk/returns of certain trading desks and strategies make sense in light of our capital base, and how to optimise our capital and funding allocation in the most effective way across the trading floor.

A diverse team and a close partnership—the keys to our success

To achieve all this, TRM have a broad team of analysts with diverse backgrounds and different specialisations across asset classes and topics. Next to the ever-important quantitative profiles such as people with either a finance background or a particular strength for numbers, we have former traders in the team, as well as people with a strong affinity for technology and scripting. Given this variety, the team can add different perspectives to the problems we’re trying to solve, and equally act as a sparring partner for Trading. The latter is also what makes this role so exciting.

Ultimately the goal of both teams is the same, i.e., contributing to the success of Optiver. While doing that and “thinking along” with the business, the Risk team needs to ensure thatOptiver stays in control via appropriate supervision, with Trading decisions made in a balanced and risk-minded way. To ensure a close partnership that yields the best result, the Risk team is also directly located on the trading floor, which facilitates easier communication and decision-making. The direct accessibility created by sitting only a few desks away from one another is very important in a fast-paced trading setup, where quick decision-making is key.

Navigating the challenge: Methodologies and tools

Having trading experience across different asset classes within the Risk team gives us a better understanding of the markets, allowing us to see where the focus points need to be to improve the risk framework.

Within Risk, we can draw on quite a broad toolkit, ranging from default option greeks to macro analysis, from stress testing to scenario analysis, and from beta scenarios to liquidity assessment to tenor points—all of which result in limit-setting, but also in being able to assess opportunities that may arise, generated by trading.

To support the setup, Risk has a dedicated Risk Technology team that covers core infrastructure and risk-tooling through the technical expertise (think Python) within the Risk team, allowing us to directly develop scripts and risk dashboards. The latter has a direct impact, as you can see your risk analysis or methodology development in production, which will be consumed across the whole trading floor via dashboards.

Many of these methodology improvement projects are also run jointly between Trading, Risk and Research.

A future in our Risk team

At Optiver, Risk is not an afterthought. It operates at the core of the trading floor and features prominently in the minds of both Trading and senior management.

Every six weeks, we convene a risk committee where senior members of Trading and Risk meet with our CEO to establish the default appetite. This close interaction and the “thinking-along” approach with Trading are quite unique, making the Risk role at Optiver both challenging and interesting. No two days are the same and every day offers new and exciting problem-solving opportunities.

Apply now

If you can see your own skills further strengthening our Risk team, contact Sophia de Rosnay ([email protected]) to get more information. We’d love to hear from you.