A little understood cost of trading options in the US

Exchanges use the Options Regulatory Fee (ORF) to cover a material portion, but not all, of their supervision and regulation of the US options market. ORF, however, is inconsistently allocated and collected across exchange groups, and there’s little transparency into how the annual regulatory budgets used to set these fees are determined. In this paper we advocate for the adoption of a standardized method for calculating and collecting ORF that would apply across all exchanges.

A little understood and often overlooked fee touches virtually every options trade made in the “Customer” range in the US. No matter if you’re a retail or institutional investor, a buyer or seller, when you trade options in the US you will almost always find a charge on your trade confirmation labeled “ORF,” or Options Regulatory Fee. This fee may be derived from every one of the 17 options exchanges, including ones you’ve never traded on. And with the addition of each new exchange, this fee only increases.

Exchanges use ORF to cover a material portion, but not all, of their supervision and regulation of the US options market. As Self-Regulatory Organizations (“SROs”), US options exchanges must monitor and perform market surveillance to help ensure the integrity of the markets in which they operate. In addition, they formulate rules, conduct investigations and bring enforcement actions, among many other regulatory functions. ORF is levied by each exchange on transactions cleared in the Customer range at the Options Clearing Corporation (“OCC”), which means it impacts retail and institutional investors accounting for nearly 50% of total industry cleared volumes.

ORF, however, is inconsistently allocated and collected across exchange groups. There’s also little transparency into how exchanges determine the annual regulatory budgets used to set these fees. There’s no requirement that these budgets satisfy an independent third-party auditor, either.

In this paper we advocate for the adoption of a standardized method for calculating and collecting ORF, one that would apply across all exchanges. Additionally, we argue in favor of a more transparent budgeting process in the way exchanges determine ORF. While exchanges play a critical role in safeguarding the integrity of options markets, this shouldn’t come at the expense of disproportionate and unnecessary costs for investors.

How ORF is calculated

Each year, US options exchanges privately estimate their regulatory budgets, predict what industry cleared Customer volumes will be, and then, based on these two projections, set a rate to recoup a portion of this budget.

ORF rates differ across exchanges because regulatory costs are theoretically different at each exchange. Each trading venue has the freedom to allocate ORF differently. The one stipulation (per the SEC’s practice of allowing SRO rule changes, including fees, to become effective on filing[1]) is that the total amount of ORF collected per individual exchange cannot exceed 100% of its budgeted regulatory costs.[2]

One outcome of this process is that each exchange sets its own ORF based on seemingly very different regulatory budgets – sometimes in excess of what one would expect based on individual operations and volumes. We recognize that, as SROs, exchanges perform numerous important regulatory tasks, including monitoring activity across all markets, and that this represents a significant cost to them. We also acknowledge that exchange fees can and should differ based on the scale and scope of an exchange’s operations. But under the current method, there is no transparency into what these regulatory costs are per exchange.

While some might argue these fees are de minimis, at scale these duplicative costs can be prohibitive for end investors. Under the current framework, should the number of options exchanges in the US grow, so will ORF, even if US options volumes were to remain constant. Optiver supports the entrance of new competing exchanges, but not at added expense to investors.

How ORF is collected

A number of factors determine who pays ORF, like a participant’s clearing status, a firm’s membership at an exchange and where the options trade is executed.

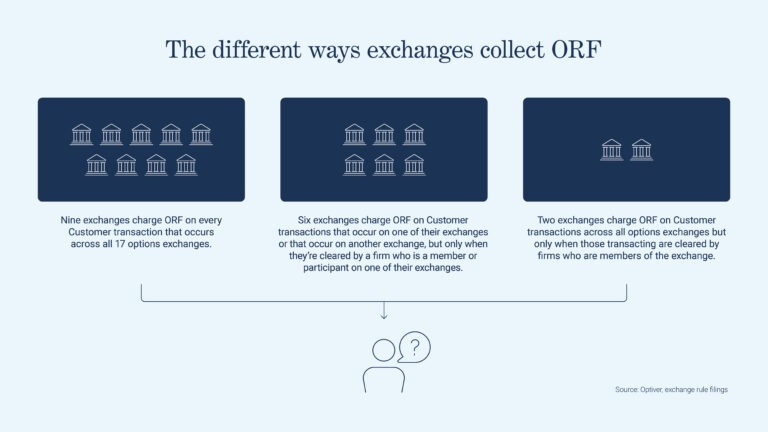

Currently exchanges use one of three methods to collect ORF:

- Nine exchanges, across four exchange groups, use the “all” method. They charge ORF on every Customer transaction that occurs across all 17 options exchanges.

- Six exchanges, from one exchange group, use the “local exchange and members only” method. These venues charge ORF on Customer transactions that occur on one of their exchanges or that occur on another exchange, but only when they’re cleared by a firm who is a member or participant on one of their exchanges.

- Two exchanges, from one exchange group, use the “members only” method. These exchanges charge ORF on Customer transactions across all options exchanges but only when those transacting are cleared by firms who are members of the exchange.

These collection methods can lead to some curious results. Not only can ORF be charged by each of the 17 options exchanges, some exchanges may levy ORF in connection with products that do not even trade on their own platforms. In other words, they can receive revenues earmarked for regulatory expenses in products they would never be able to host transactions in.

Proposed solution

Optiver proposes a principles-based approach, which combines an improved allocation and collection methodology with a transparent and audited regulatory budgeting process. The following measures would reduce inefficiencies in the way exchanges manage their regulatory resources and allow for a more level comparison across exchanges. Furthermore, they present an opportunity for cost savings to end investors, while also working to ensure markets remain fair and competitive.

Improved regulatory oversight

- Exchanges should clearly define their allocation, collection and budgeting methodologies for ORF and engage the SEC in a transparent process to review, approve or audit each exchange’s approach on an annual basis.

Uniform allocation methodology

- Exchanges should adopt a uniform method for allocating ORF, as a way to remove ambiguity and provide market participants with a transparent way of determining the regulatory cost of each exchange.

- Exchanges should charge ORF only in relation to transactions that occur on their own exchange.

- Under this model, participants across all clearing ranges would be eligible to be charged ORF.

- Exchange members who are registered market makers in appointed classes should be exempt from ORF in order to incentivize market makers’ liquidity provision.

Regulatory budgeting process

- Exchanges should identify expected and reasonable regulatory costs through a transparent process subject to SEC review and approval. This budget, in conjunction with the defined uniform allocation method, should dictate the ORF charges at the exchange level.

Conclusion

Optiver acknowledges the important roles that exchanges and the SEC play in ensuring the integrity of US financial markets. ORF, however, is at odds with the qualities typically associated with a healthy market structure, such as transparency, accessibility and predictability. Any one of the 17 US options exchanges, using the solutions proposed in this paper, could take a major step forward for the US options market, more closely aligning it with the interests of end investors. Optiver welcomes the opportunity for broader industry discussion with regulators, exchanges and market participants on a renewed approach to ORF.

[1] Under SEC Rule 19b-4, an SRO’s rule change, including the imposition of a fee, becomes effective when it is filed by the SRO with the SEC. The SEC can retroactively suspend such a change if the Commission finds reason to do so. See 17 CFR 240.19b-4. See also, 15 U.S.C. 78s(b)(3)(A)(ii)

[2] See e.g. Self-Regulatory Organizations; MEMX LLC; Suspension of and Order Instituting Proceedings to Determine Whether to Approve or Disapprove a Proposed Rule Change to Amend its Fee Schedule to Establish an Options Regulatory Fee

To discuss this paper – or any other market structure topic – reach out to the Optiver Corporate Strategy team at [email protected]