One key lesson from the latest CCP fire drill

Fire drills are a vital way of preparing the industry to effectively respond to a major default. Standardising the process by which members bid on the portfolios of a hypothetical defaulting firm would ensure a stronger, faster and more consistent response.

November’s International Default Simulation was designed to prepare global capital markets for a scenario that, while undesirable, is nevertheless a real possibility in our complex and interconnected financial world.

Whether it’s due to financial distress or liquidity problems, a major financial firm may fall into difficulty and default with multiple central counterparties (CCPs). This situation could set off a chain reaction that damages market integrity and saps overall market confidence.

Global regulators coordinated November’s simulation to prepare financial market infrastructure and participants for precisely this type of scenario. As part of the exercise, CCPs simulated emergency auctions in which members bid on the portfolios of a hypothetical defaulting firm. In a real-life situation, the winning bidders for each auction would take over the defaulting portfolio, helping to absorb the shock of a major failing participant.

Fire drills are a vital way of preparing the industry to effectively and efficiently respond to a major default. More importantly, they present us with the opportunity to make fixes that could ensure an even more robust reaction if a crisis actually hits.

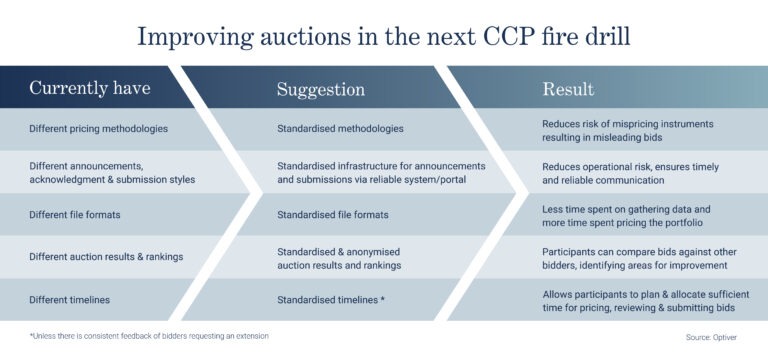

November’s exercise revealed a clear need for greater standardisation. As things stand, each CCP that participates in the fire drills runs its own auction process, with distinct pricing methodologies, formats and timelines. Standardising these features across all CCPs would go a long way toward ensuring a stronger, faster and more consistent response. Based on our experience as a fire drill participant, here are some recommendations on how this could be achieved.

The benefits of standardisation

Optiver’s role in the fire drill was to review and price the hypothetical portfolios of defaulting members and submit bids for all or part of them. This required us to engage individually with each CCP. While in each case we were able to prepare and submit bids, we encountered a wide mixture of different requirements among the various CCPs.

When it came to bidding in the auction, here are some of the things we encountered:

- Different pricing methodologies for bidding.

- Different submission styles. We observed both manual submissions via e-mail or via a portal.

- Different acknowledgement types. Some CCPs required that participants acknowledge announcements (invitation, portfolio sharing), others didn’t.

- Different file formats. Each CCP used a different format on Excel.

- Different timelines. Some CCPs accepted extension requests from participants, others didn’t.

This non-exhaustive list reveals a potential sticking point in a real-life crisis scenario. While we recognise that a fully harmonised process may take some time, the current absence of standardisation increases operational risks. Complexity can lead to confusion, particularly when participants are forced to navigate different requirements in a very short time frame. This could impact market participants’ ability to effectively participate in the auctions, especially during stressed market conditions. If all of the above were standardised, market participants could have devoted more time to actually pricing the portfolios instead of navigating the assorted requirements.

In the table below, we lay out our suggestions for standardising auctions and the benefits it would bring:

We believe consistent pricing methodologies are the most critical aspect of this. In practice, this means auction participants would be shown a single book, giving them visibility on offsetting positions, as well as offering them an option to price the whole book or a proportion of the overall book and providing reference settlement prices for futures.

To coordinate this process, the industry could appoint a central entity with a global reach and relevant expertise, e.g. IOSCO or a CCP trade association, to set guidance or establish these standards.

While November’s fire drill revealed an industry prepared to tackle a major default, it also presented us with an opportunity to standardise our approach to emergency auctions, which could ensure an even more robust response if a crisis actually hits.

To discuss this paper – or any other market structure topic – reach out to the Optiver Corporate Strategy team at [email protected]

DISCLAIMER: Optiver V.O.F. or “Optiver” is a market maker licensed by the Dutch authority for the financial markets to conduct the investment activity of dealing on own account. This communication and all information contained herein does not constitute investment advice, investment research, financial analysis, or constitute any activity other than dealing on own account.