Central clearing: an essential post-trade function

Much of the attention paid by the public to financial markets is typically directed at pre-trade – when orders go into an order book to be filled – or trading itself. Occasionally however attention shifts to post-trade, or what happens after a trade has been agreed. Now is one of those times, with the US’s move to T+1 settlement slated for next year.

When market participants debate the pros and cons of shortening the settlement cycle to T+1, much of what they’re talking about is clearing. Clearing is what paves the way for settlement to occur within a prescribed time, helping markets remain predictable and efficient. It’s the process by which trade details are confirmed, funds are verified and the obligations of each side are calculated. Afterwards, the parties can proceed to actually exchanging cash and securities.

In this Explainer, we’ll lay out the basics of central clearing and why it’s an important piece of the financial markets.

How central clearing works

Central clearing (as opposed to bilateral clearing) is typically used in exchange-traded markets, where trades are standardised and easily replicable. Bilateral clearing in contrast usually occurs in over-the-counter (OTC) markets where trades are highly customised and not easily standardised. One of the main actors in central clearing is the central clearing house, or central counterparty (CCP). CCPs are regulated entities, typically operated by infrastructure providers such as exchanges or independent clearing organisations. As such, they’re required to maintain sufficient financial resources.

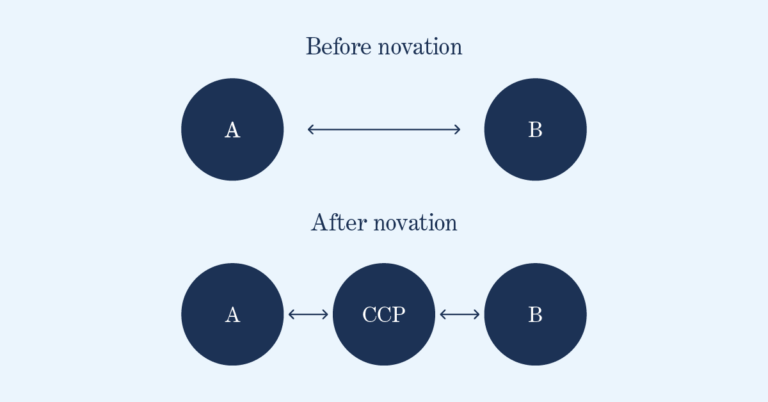

CCPs stand between the buyer and seller in a trade. In order to do so, they make use of a legal concept called ‘novation.’ Novation is when a single contract between two parties is replaced by two contracts: one between the buyer and the CCP, and the other between the seller and the CCP (see figure below). In this way, the CCP can simultaneously face both parties to a trade and ensure that each side is meeting its obligations.

Clearing is the process by which the CCP performs three principal functions:

- Trade verification. The CCP verifies which financial instruments are being traded, the quantity, the price and the settlement date. One of the reasons for this step is to ensure that both parties have sufficient funds or securities to settle their trade.

- Netting. Following verification, the CCP calculates the net positions between the buyer and seller. The reason for this is that the CCP can consolidate multiple trades into a single transaction, reducing the number of settlement obligations and associated costs between the two parties.

- Margining. The CCP sets an amount of collateral that each party must post. It bases this decision on the risk of the financial instruments being traded and the creditworthiness of the parties involved. This process, known as ‘margining,’ is designed to cover their losses if a default occurs. The collateral requirement may come in the form of cash, securities or a combination of both.

Successful completion of these steps ensures settlement can occur in a timely and efficient manner, reducing the risk of default and promoting confidence in the financial system.

Why central clearing is important

Central clearing grew more prevalent after the financial crisis of 2008. Prior to the crisis, many derivatives trades were conducted bilaterally between two parties without the involvement of a central clearinghouse. In bilateral clearing, each party assumes the counterparty risk of the other and settlement is performed directly between the parties. This means that if one party to a trade defaults, it could have a domino effect, impacting other parties and potentially leading to a systemic crisis. In response, regulatory reforms were introduced to prevent this from happening, one aspect of which was the promotion of central clearing for standardised derivatives through CCPs. By inserting themselves between counterparties, CCPs effectively mutualize and manage the counterparty credit risk.

It’s worth noting that while CCPs help mitigate certain risks, they also carry their own, such as the concentration of risk within the CCP itself. For this reason, regulators set standards for how clearinghouses must operate, including capital requirements, risk management practices and operational procedures.

In sum, by ensuring that settlement can occur in a timely and safe manner, central clearing boosts efficiency and helps promote confidence among market participants, making it a critical piece of our financial market infrastructure.

Click here to read our other explainers.

To discuss this paper – or any other market structure topic – reach out to the Optiver Corporate Strategy team at [email protected]