5 things you should know about: market-wide circuit breakers

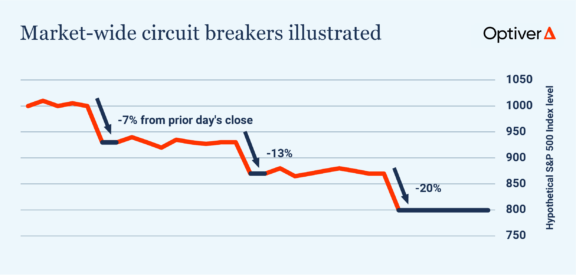

1. Market-wide circuit breakers are triggered by rapid and extreme price declines in the S&P 500 Index, a widely-followed benchmark for US equities. (A similar mechanism is in place for Canadian stocks but nothing of the sort exists in Europe or Asia Pacific.) Circuit breakers pause trading to let market participants stop and assess the situation. The following moves trigger circuit breakers:

- a 7% decrease in the index measured against the prior day’s close (known as a Level 1 halt)

- a 13% decrease measured against the prior day’s close (Level 2)

- a 20% decrease measured against the prior day’s close (Level 3)

2. Market-wide circuit breakers halt trading in all symbols on US equity exchanges (whether or not they’re constituents of the S&P 500), as well as all stock options and certain index-related symbols on futures exchanges. Product-specific circuit breakers suspend trading only in certain instruments, such as individual stocks or futures contracts (which we cover in this explainer).

3. Level 1 and Level 2 halts can occur only between 9:30am and 3:25pm. If a 7% or 13% decline occurs at or after 3:25pm, trading continues. Level 3 halts can happen at any time during regular trading hours. Level 1, 2 and 3 halts can occur only once during a trading day. So if a Level 1 halt occurs, markets must decline at least 13% before a Level 2 halt kicks in. It’s worth highlighting that market-wide circuit breakers don’t apply during extended trading hours, a topic we address in this paper.

4. When a Level 1 or Level 2 halt occurs, trading pauses for 15 minutes. In a Level 3 breach, trading stops for the rest of the day. The trading pauses are intended to establish calm. During the halt, a reopening auction takes place, after which trading resumes. After a Level 3 halt, regular trading resumes the next day with a normal opening procedure.

5. Level 1 circuit breakers have been triggered just four times: on March 9, March 12, March 16 and March 18, 2020 during the coronavirus outbreak. Market-wide circuit breakers were also triggered several times on Oct. 27, 1997, during the Asian financial crisis, but that was an earlier version linked to the Dow Jones Industrial Average. To date, markets haven’t experienced any Level 2 or Level 3 halts.

Further reading:

- Our paper in which we advocate for improving market-wide circuit breakers during pre-open/extended trading hours.

- A guide from Optiver that explains how price controls work for individual instruments traded on US exchanges.

- Our LinkedIn Pulse explaining daily price limits in wheat futures.

- A CNBC editorial about market-wide circuit breakers from March 2020.