Insight to action: The world of equity analysts at a market maker

Investment acumen meets instinct

In the ever-evolving world of the capital markets, the role of Equity Analyst stands out as a goal for those with a penchant for curiosity, analysis and investment acumen. The position is not just coveted for its intellectual rigor and the pivotal role it plays in investment decisions. Essentially, it provides a gateway to understanding the psychology of global financial markets and the opportunity to influence vast sums of capital flows.

Among the spectrum of opportunities within finance, the Equity Analyst at a market maker or proprietary trading firm represents a particularly exciting and relatively new frontier. This role offers a unique vantage point, combining the analytical depth of traditional equity research with the thrilling pace and complexity of trading. It’s where quantitative acumen meets instinct, creating opportunities for innovation and tangible bottom-line impact.

To better understand this role, we delve into the life and insights of Celine Zhao, Optiver’s Head of U.S. Equity Research. Her career trajectory from an electrical engineering graduate to heading her own team at a prominent global market maker offers a unique lens through which to understand the multifaceted role of equity analysts in today’s fast-paced financial markets.

Graduating from NYU with both Bachelor’s and Master’s degrees in electrical engineering, Celine’s first exposure to the world of finance began at J.P. Morgan in New York City. Her engineering background lent her a distinctive edge, particularly in covering the TMT sector, highlighting the increasing relevance of quantitative skills in finance. After honing her expertise in traditional asset management for seven years, Celine ventured into the market maker space when she joined Optiver, shifting her focus to options and the broader implications of market dynamics.

The shift from J.P. Morgan to Optiver was marked by significant learning curves and challenges, chiefly adjusting to the short-term, tactical nature of trading compared to the long-term investment perspective prevalent in traditional asset management. Optiver’s rigorous training programs, particularly in options theory, facilitated this successful transition.

A new perspective on equity analysis

Unlike traditional asset management roles, Celine’s current position involves deep dives into not only the directional trends of stocks, but also their volatility aspects. This holistic approach is pivotal in understanding and predicting market movements, making equity analysts essential to the strategic trading decision-making process. This aspect additionally opens opportunities for deepening knowledge across a wide variety of sectors. It also tests an analyst’s capacity for rapid, effective decision making, as they often are required to act on short-term information in a more systematic way than traditional long-only analysts.

Celine’s daily routine as an equity analyst is rigorous and dynamic. It starts with a thorough review of market news, followed by discussions with traders to align on signals and strategies. The role demands constant interaction with traders -understanding flow information and integrating it with fundamental analysis to make informed trading decisions. This closely collaborative approach is foundational to navigating the markets effectively.

Fundamental analysis stands as the foundation of decision-making for equity analysts, enabling them to distill a company’s value from vast datasets, market noise and financial reports. By carefully evaluating a company’s financial health, growth prospects, industry position and broader economic indicators, equity analysts wield the power to forecast future price movements and uncover hidden investment truths.

For Celine, fundamental analysis is not merely academic — it’s a practical tool that shapes strategy and guides trading decisions. It allows her and her team to construct robust models that predict how external factors, earnings reports and economic trends might influence stock performance. In a world where speed and insight lead to success, the application of fundamental analysis remains a constant.

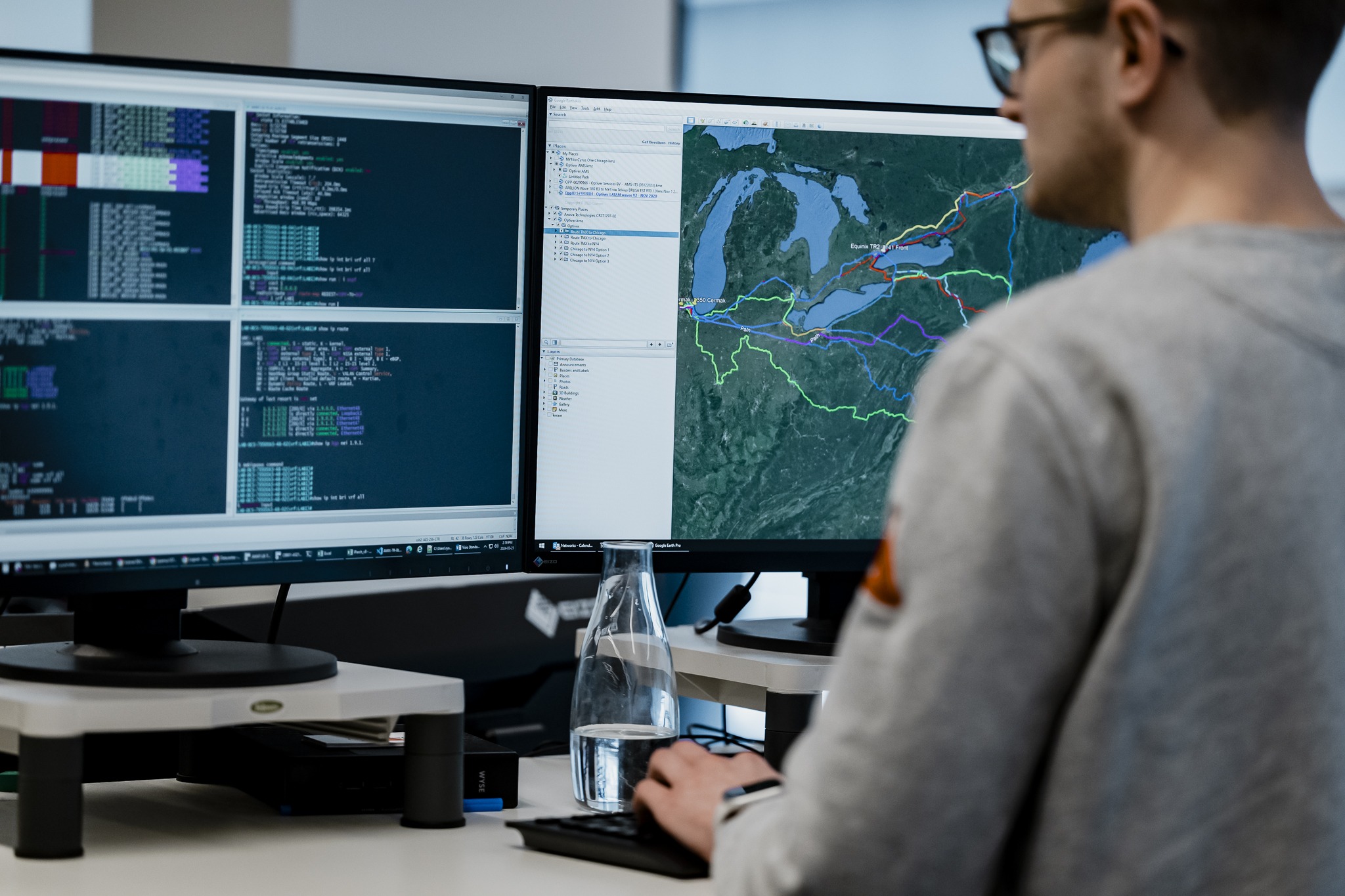

Harnessing data and new technologies

Increasingly, technology, and particularly AI, is playing a transformative role in enhancing the efficiency and depth of equity analysis.

“AI has revolutionized the way analysts process vast amounts of information, enabling them to focus more on developing comprehensive trade ideas. Optiver leverages proprietary AI systems, among other technologies, to stay at the forefront of the market making industry, illustrating the critical role of innovation in maintaining competitive edge.”

-Celine Zhao

Celine mentions one of her favorite parts about working at a market maker is the expanded perspective offered via unparalleled insights. Equity analysts on her team enjoy access to a wealth of data and information flows, providing a comprehensive understanding of market dynamics across asset classes. This environment, over time, builds a deep, integrated and continuous knowledge of securities, differentiating it from the more segmented focus typical of buy-side or sell-side analyst roles.

So, what makes a successful equity analyst?

“It hinges on passion, curiosity, and effective communication. The ability to distill complex information into actionable insights is crucial, especially when working alongside traders under tight time constraints. Continuous professional development, supported by comprehensive training programs, remains a cornerstone of my team to nurture talent.”

-Celine Zhao

The way forward

Celine’s experience also touches on the broader issue of gender representation in finance. Despite the challenges posed by a traditionally male-dominated field, she emphasizes the merit-based culture at Optiver, which has fostered a balanced team dynamic. Her advice to aspiring female analysts is to focus on excellence and curiosity, as these qualities are instrumental in driving success and advancement in the industry.

Looking forward, Celine envisions the role of equity analysts continuing to evolve, particularly in terms of generating actionable trade ideas and understanding portfolio risk-reward dynamics. This evolution reflects a broader industry trend towards more sophisticated, data-driven analysis, emphasizing the growing importance of quantitative skills and technological proficiency.

Explore our global trading opportunities

At the intersection of technology and finance, our trading career paths offer a unique opportunity to delve into market dynamics and contribute to cutting-edge trading strategies. If you’re a forward-thinker with strong analytical skills, we invite you to apply. New positions open regularly.