Volatility views: Traders are sanguine about US midterms. Too sanguine?

Snapshot: While upcoming US midterm elections have generated plenty of headlines, to date there has been relatively little in the way of market volatility in relation to the event. That could change should Democrats tighten their control of Congress.

Author: Tom Borgen-Davis, Optiver Head of Equity Research

Polls and betting markets are predicting that control of one or both chambers of Congress will pass to Republicans following the US midterm elections on Nov. 8. The Democrats currently have a slim majority in the House, while they control the Senate thanks only to the vice-president’s tie-breaking vote, which has led to protracted policymaking and difficulties in legislating. As of recently, Betfair implied a 91% probability that Republicans will take the House. The Senate appears to be a closer race but Republicans also lead.

How are traders preparing for potential market moves around the upcoming elections?

Options markets imply a small gain in US and EU stock indices should the Republicans regain power of Congress. That’s largely because Republicans’ policies are seen as deflationary relative to Democrats’.

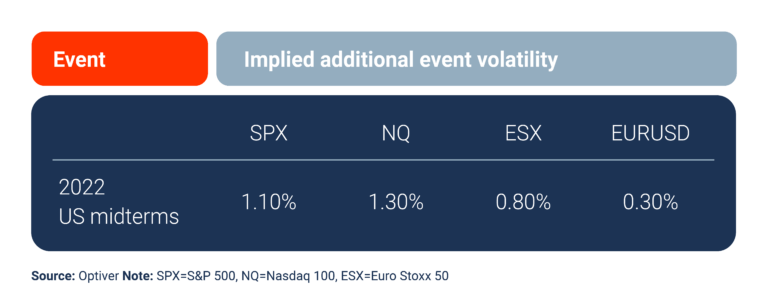

Here’s what’s currently implied from options prices in terms of excess event-related volatility for the US midterms, according to Optiver data. In other words, here’s how much the event is expected to impact the following indexes and currency pairs over and above normal volatility:

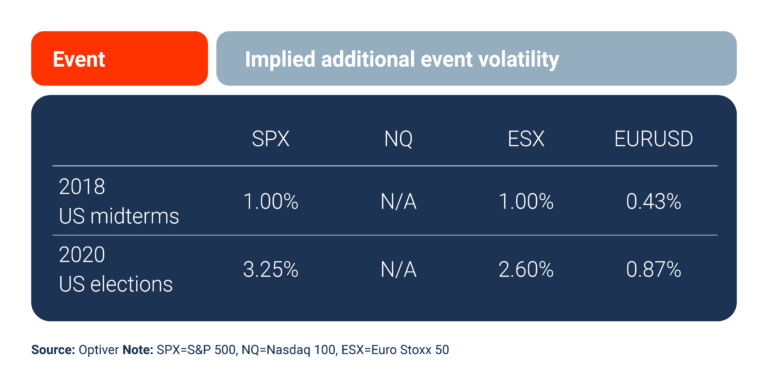

Now let’s compare that snapshot with how options markets expected some other recent US political events to unfold. Here, for instance, is how much excess event-related volatility options traders expected in the aftermath of the 2018 midterms and the 2020 US presidential election (note that these figures have not been normalized for the prevailing volatility environment):

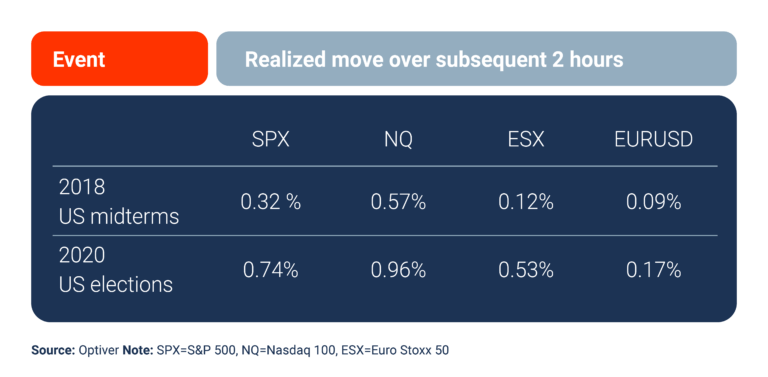

Now let’s see what actually happened. Here is how much markets actually moved in the two hours following those events:

What these tables show is that recent US political events have tended to under-realize compared with expectations. For instance, traders expected excess event-related volatility of 3.25% in the S&P 500 following the 2020 presidential election – the index ended up moving a much more modest 0.74%.

While this limited historical sample suggests we may be in for a relatively quiet market reaction, a strong showing for Democrats could flip things the other way. In particular, it could raise fears of more aggressive fiscal spending and taxation, along with a higher risk of regulation for technology companies.

In other words, in the unlikely event that Democrats tighten their control of Congress on Nov. 8 – a surprise outcome – we could see a much sharper negative reaction in equities.

For media inquiries, contact [email protected]

Disclaimer

Optiver V.O.F. (‘Optiver’) is a market maker licensed by the Dutch Authority for Financial Markets to engage in the investment activity of dealing on own account. This communication and all information contained herein, including any attachments, are confidential and intended solely for the use of the individual addressee(s) or, on a need to know basis, their employees and directly appointed agents. This document is for informational purposes only. It is not a recommendation to engage in investment activities and must not be relied upon when making any investment decisions. This document has been provided to you without charge for your convenience only. All information contained in this material is factual information and does not reflect any opinion or judgement of Optiver. This document does not take into account the investment objectives or financial situation of any particular third-party. All investments involve risk and no portion of this document should be interpreted as legal, financial, tax, or accounting advice, and should not be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap, or other derivative or financial instrument. There are no warranties, expressed or implied, as to the accuracy or completeness of any information provided herein. Optiver does not warrant or guarantee the accuracy of any information or opinions in this document. Any trading activity conducted with Optiver shall at all times be subject to the current Optiver Terms of Business. Please contact your Optiver representative for a copy of the latest version of these terms of business.