Volatility views: Banking stress raises potential for volatile Fed decision

Snapshot: Recent market turmoil has options traders anticipating significant swings around the March 22 FOMC statement.

Author: Tom Borgen-Davis, Optiver Head of Equity Research

The Federal Reserve has spent the past year fighting inflation while trying to avoid tipping the US economy into recession. Now there’s a new factor in the mix: the risk of intensifying stress in a banking sector already reeling from the quickest pace of interest rate hikes in decades.

That’s setting up one of the most hotly-anticipated FOMC decisions in recent memory on March 22. The Fed must weigh whether to continue the battle against inflation or pause in light of the turmoil inflicted on the banking sector by rising rates.

While the start of the month saw many economists surveyed by Bloomberg predicting a 50 basis point hike this week, a majority now expect the Fed to raise rates by a quarter point. Some analysts expect policymakers to stand put or even cut rates. Last week’s European Central Bank meeting muddied the outlook further. Investors anticipated a shift only for policymakers to stick to their original plan of a 50 basis point hike.

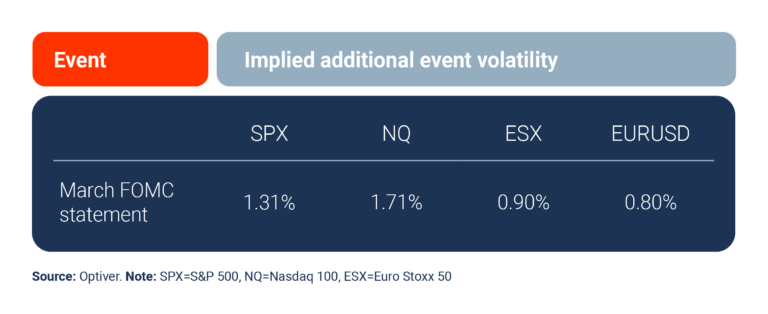

Here’s what’s currently implied from options prices in terms of excess event-related volatility for the March 22 policy statement, according to Optiver analysis. In other words, here’s how much the event is expected to impact the following indexes and EUR/USD over and above normal volatility, 30 minutes after release of the statement.

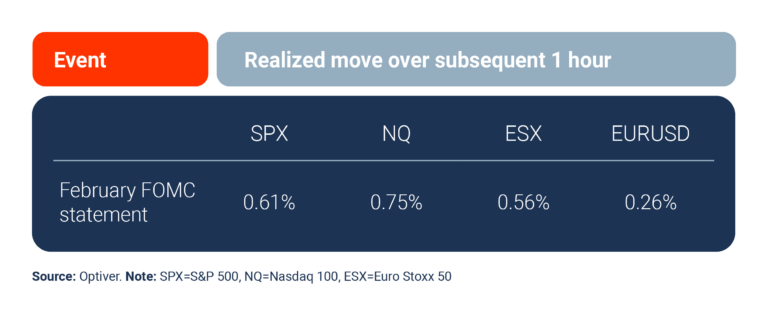

For context, here’s how much markets realized in the one hour following the release of the last FOMC policy decision on Feb. 1 (which includes the start of the press conference), when policymakers raised rates by 25 basis points.

Market reaction could be significant should the Fed make a surprise move in either direction. Should the FOMC keep interest rates unchanged, S&P 500 Index futures imply a positive reaction in the range of +1.5% to +2.5% for the trading day. Conversely, if the Fed hikes rates by 50 basis points, the S&P 500 Index could drop -2% to -3%, according to options prices.

Investors will also be keeping a close eye on the press conference following the decision. While Fed funds futures have been pricing a terminal rate of 5.25%-5.5%, guidance could reveal a rate closer to 5% given recent developments.

For media inquiries, contact [email protected]

Disclaimer

Optiver V.O.F. (‘Optiver’) is a market maker licensed by the Dutch Authority for Financial Markets to engage in the investment activity of dealing on own account. This communication and all information contained herein, including any attachments, are confidential and intended solely for the use of the individual addressee(s) or, on a need to know basis, their employees and directly appointed agents. This document is for informational purposes only. It is not a recommendation to engage in investment activities and must not be relied upon when making any investment decisions. This document has been provided to you without charge for your convenience only. All information contained in this material is factual information and does not reflect any opinion or judgement of Optiver. This document does not take into account the investment objectives or financial situation of any particular third-party. All investments involve risk and no portion of this document should be interpreted as legal, financial, tax, or accounting advice, and should not be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap, or other derivative or financial instrument. There are no warranties, expressed or implied, as to the accuracy or completeness of any information provided herein. Optiver does not warrant or guarantee the accuracy of any information or opinions in this document. Any trading activity conducted with Optiver shall at all times be subject to the current Optiver Terms of Business. Please contact your Optiver representative for a copy of the latest version of these terms of business.