Volatility views: November CPI print carries potential for elevated volatility

Snapshot: Following last month’s surprise inflation miss, S&P 500 options prices imply significant volatility should CPI come in higher or lower than expected.

Author: Tom Borgen-Davis, Optiver Head of Equity Research

This week’s November US Consumer Price Index reading will be closely watched by investors. Scheduled for Dec. 13, it’s not only the final reading of 2022, but follows October data that showed a surprise slowdown in price pressures. That release sparked a 5.5% rally in the S&P 500, the best first-day reaction to a CPI report since at least 2003, according to Bloomberg.

Recent non-farm payroll and ISM data rattled markets, raising the stakes for the Dec. 13 release. A lower-than-expected CPI print could signal a trend of inflation returning to the Fed’s target long-term level of 2%, which could mean a hike of less than 75bp at the FOMC meeting on Dec. 14. If however the print is significantly higher, it could mean more aggressive Fed action and increased market fears over inflation.

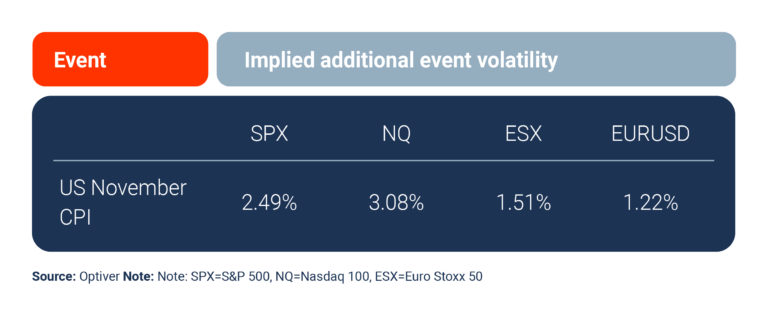

Here’s what’s currently implied from options prices in terms of excess event-related volatility for November CPI, according to Optiver data. In other words, here’s how much the event is expected to impact the following indexes and currency pairs over and above normal volatility, one hour after its release.

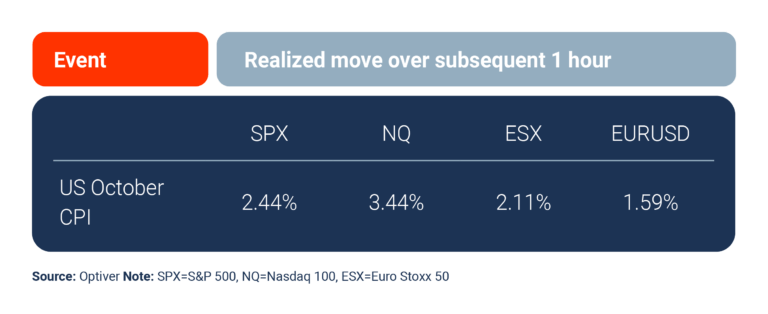

For context, here’s how much markets moved in the one hour following the release of October CPI on Nov. 10. This suggests options markets are bracing for similar volatility to that seen on Nov. 10.

Analysts anticipate headline US CPI to have increased 0.3% month on month and 7.3% year on year, and for core inflation (which excludes food and energy) to have gained 0.3% month on month and 6.1% year on year, according to Bloomberg.

Recall that core CPI for October came in 0.2% lower year over year than expectations. Should inflation once again come in 0.2% lower than expectations, S&P 500 Index options imply a positive reaction in the range of 2.5% to 5.5% for the trading day.

Conversely, if inflation comes in 0.2% higher than expectations, the S&P 500 Index could drop 3%-6% according to options prices, potentially retracing the majority of gains it saw on Nov. 10.

Inflation has been a key theme of 2022. Whatever the reading on Dec. 13, we expect US CPI to remain a focus for global markets over the coming months.

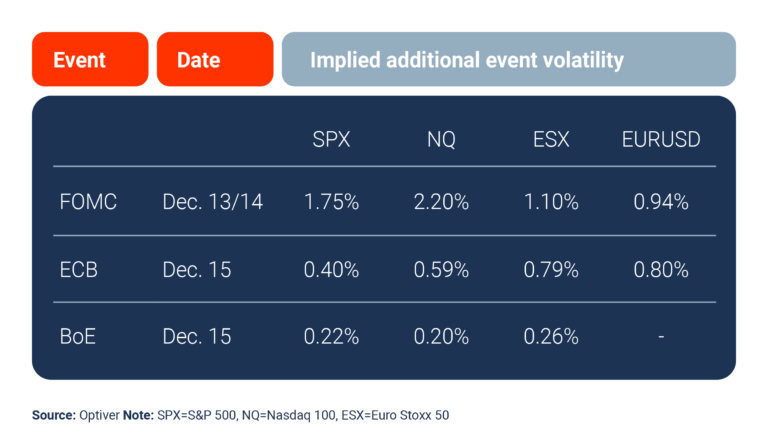

US CPI is hardly the only important event this month. Options traders are also closely watching policy decisions from the FOMC (Dec. 13/14), the European Central Bank (Dec. 15) and the Bank of England (Dec. 15).

Here’s what’s currently implied from options prices in terms of excess event-related volatility for these events, according to Optiver data. In other words, here’s how much the events are expected to impact the following indexes and currency pairs over and above normal volatility, in the hour after the announcement.

For media inquiries, contact [email protected]

Disclaimer

Optiver V.O.F. (‘Optiver’) is a market maker licensed by the Dutch Authority for Financial Markets to engage in the investment activity of dealing on own account. This communication and all information contained herein, including any attachments, are confidential and intended solely for the use of the individual addressee(s) or, on a need to know basis, their employees and directly appointed agents. This document is for informational purposes only. It is not a recommendation to engage in investment activities and must not be relied upon when making any investment decisions. This document has been provided to you without charge for your convenience only. All information contained in this material is factual information and does not reflect any opinion or judgement of Optiver. This document does not take into account the investment objectives or financial situation of any particular third-party. All investments involve risk and no portion of this document should be interpreted as legal, financial, tax, or accounting advice, and should not be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap, or other derivative or financial instrument. There are no warranties, expressed or implied, as to the accuracy or completeness of any information provided herein. Optiver does not warrant or guarantee the accuracy of any information or opinions in this document. Any trading activity conducted with Optiver shall at all times be subject to the current Optiver Terms of Business. Please contact your Optiver representative for a copy of the latest version of these terms of business.