‘It’s not over yet’: traders weigh up this year’s volatility

Tried-and-true hedges that have stopped working. Correlations that are out of whack. A “cocktail” of troubles just over the horizon.

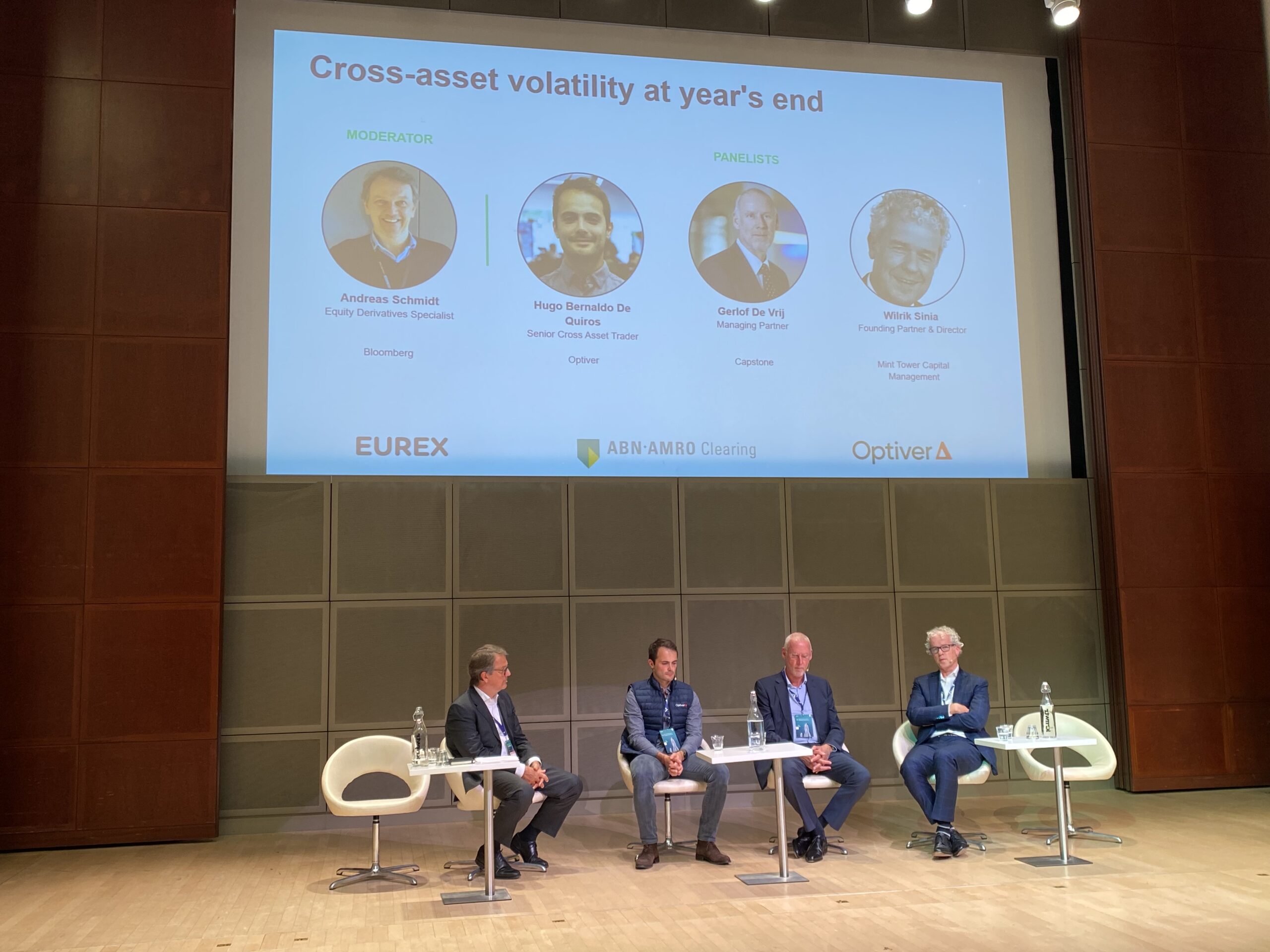

Caution was in the air at the volatility panel during this month’s Eurex Derivatives Forum in Amsterdam, sponsored by Optiver. Panelists’ concerns ranged from central banks’ inability to tame inflation, to the raging energy crisis to growing macro uncertainty.

It wasn’t all doom-and-gloom. After a decade-long bear market, energy is exciting again, cross-asset volatility has become “interesting” and trend-following is turning into the year’s big winner. While many have been forced to tear up their playbooks, for others that’s spelled opportunity.

Here are highlights from the conversation, which was moderated by Bloomberg’s Andreas Schmidt.

Participants:

- Hugo Bernaldo, senior cross-asset trader at Optiver

- Gerlof De Vrij, managing partner at Capstone

- Wilrik Sinia, founding partner and director at Mint Tower Capital Management

Hedges in turmoil

Traditional equity hedges have largely failed to do their job this year as stocks have slowly grinded lower. “Buying puts doesn’t work; convexity doesn’t work – we’ve all been a bit puzzled by that,” said Optiver’s Bernaldo. Still, there are ways to protect portfolios, even in this environment. “Directional hedges make more sense at this stage than convex hedges because you’re already in an elevated volatility regime,” said De Vrij of Capstone.

Trend is your friend

One defensive strategy that’s working is trend-following. An index tracking the strategy was as of recently headed for its best 12-month period on record. “Trend has been super-defensive this year, and still is,” said De Vrij. But implementation is all in the details, he said. “You need to do it over a super-broad universe. The slower your trend signal, the better it will be in this market, because it won’t get stopped out or whipsawed by these short-term rebounds.”

Correlation breakdown

Relationships that traders used to rely on – between stocks and bonds, oil and equities – are vanishing. “Mean reversion and all these old-fashioned relationships, they do not tend to work very well at the moment,” said Mint Tower’s Sinia. Relative value has flopped as a result, forcing many volatility traders into unfamiliar territory. “Things that are driving the market – geopolitics or the supply side in commodities – are making the data about how asset classes behave totally unreliable,” said Bernaldo. To De Vrij, the shifting correlations have made cross-asset volatility “super interesting.”

“The new dynamic has really turned everything around this year,” he said.

‘It’s not over yet’

A point of consensus among the panelists is that we’re not yet through the worst. With inflation still coming in hot, there’s seemingly little to suggest that central banks will pivot from their hawkish stance. That’s raising recessionary risks for the global economy. “It’s very difficult to get inflation down,” said De Vrij. “Once the genie is out of the bottle, it’s very hard to get him in – it’s not over yet.”

Energy will continue to be in focus, the panelists agreed, after this year’s historic commodities swings. “The energy problem is going to hang around for a long time,” said Sinia. On the bright side, “it’s the first time the sector has been exciting in quite a while,” according to Bernaldo.

Overall the mood remains cautious. With macro storm clouds still forming, and growing worries over the impact to corporate earnings, bullishness was in short supply.

“Inside, I’m pretty bearish,” said Sinia.

De Vrij agreed: “It’s a cocktail of trouble.”

DISCLAIMER: Optiver V.O.F. or “Optiver” is a market maker licensed by the Dutch authority for the financial markets to conduct the investment activity of dealing on own account. This communication and all information contained herein does not constitute investment advice, investment research, financial analysis, or constitute any activity other than dealing on own account.