Trading Careers at Optiver APAC

What’s it like to Work in Trading at Optiver?

We asked our Trading team to explain what it’s like to work on our Trading floor, and what it takes to be great.

What is Market Making?

Market Making is our core trading strategy. Many exchanges recognise Market Making as an official role within the trading ecosystem. It refers to a trading participant (in our case, us), that makes it easier and cheaper for others to trade. Buyers and sellers want to trade financial instruments on exchanges. Without Market Makers, many products may be illiquid, meaning buyers and sellers would find limited opportunities to buy or sell a product of interest.

As Market Makers, we abide by a set of rules that ensure we are improving the market through our participation. These rules detail the maximum spread between our buy price and our sell price, the minimum volumes we need to show and ensure we are providing buy and sell prices immediately when requested by other market participants. We have to know a lot about the markets we operate in, as well as the range of financial instruments and products we’re trading. Fast and effective technology enables us to provide competitive quotes, quick execution speeds and risk management.

What skills do you need to be a great Trader?

Many things combine to making a good trader. It takes strong problem-solving skills and exceptional analytical and quantitative ability. And you need to be able to maintain a practical, calm demeanour so that you can think clearly in an unpredictable environment. Some days, things don’t go to plan. So you’ll need resilience to cope with the hits and find your way back to glory. Trading comes down to paying attention to the critical questions. You need to know the risks involved with the current situation and diagnose the issues at any given moment. What is the right call to make?

Making quick and informed decisions based on massive amounts of information is a critical skill set. You’ll continuously be interpreting changing market conditions, market prices and trades, monitoring and modifying our auto-trading system parameters while planning a course of action and seeing it through. Traders often have to think and act instantaneously. If something goes wrong, a good Trader can quickly rectify the issue and continue trading with minimal disruption.

Being a great trader also stems from a strong willingness to learn and improve. Great traders demonstrate a passion for Trading and eagerness to learn and continually improve. It can be a demanding job, but those with the passion, tenacity and hunger for it will be the ones that can confidently call themselves great.

What are the different types of Trading?

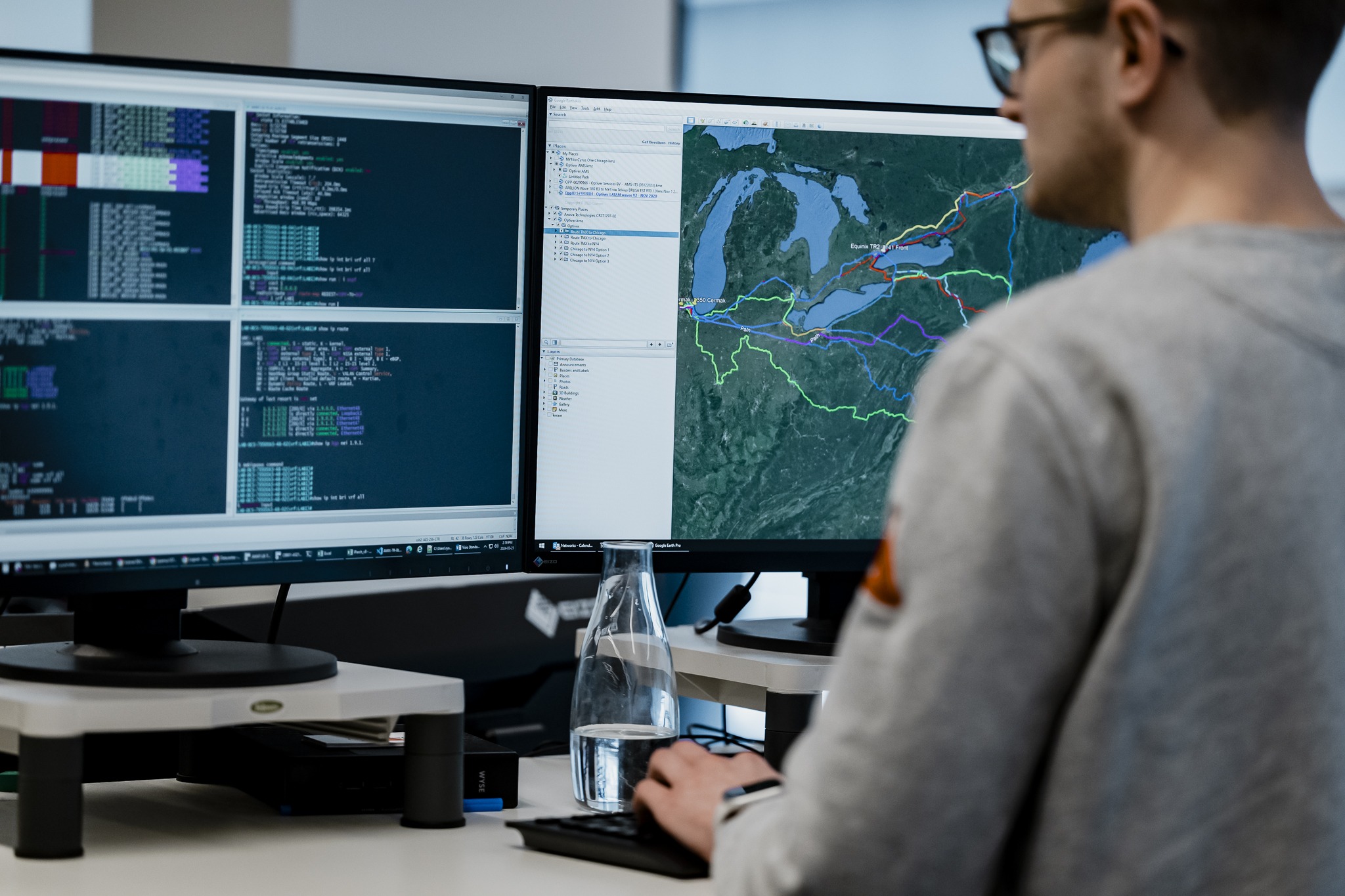

There are two kinds of Trading at Optiver – Screen Trading and Wholesale Trading. Most of our traders are Screen Traders, so let’s start there. Screen Traders use computer interfaces to execute electronic trades on the exchange. They also monitor and assess markets, looking for opportunities to improve risk management. Technology plays an integral role in the way we trade. Screen Traders focus on monitoring and guiding the parameters of our autotraders (automated systems that execute trades on the exchanges).

Wholesale Traders focus on the Inter-dealer bank (IDB) broker market. This market includes investment banks, hedge funds and algorithmic trading firms. These parties tend to have more capital and are more likely to trade derivatives in a larger size. Unlike Screen Traders, most Wholesale Trading happens over the phone and involves more interaction with external parties.

Both Screen and Wholesale Traders work intensely with numbers and apply a combination of both Market Making and position-taking strategies.

Optiver trades a range of financial instruments. People often think of stocks when they think of Trading, and we certainly trade stocks and similar products directly on the exchange. However, we also trade derivatives, which means the value of the contract being traded is derived from another product, such as a stock. The types of derivatives we trade are called futures and options.

How does Optiver improve the market?

Trading responsibly and ethically is our priority. As a market maker, we provide liquidity, which means we provide more trading opportunities for other trading participants. We do this by showing a buy and sell price at a reasonable volume, making the fair price of the market easier to determine. By doing this, we also correct imbalances in the number of buyers and sellers. By offering competitive prices, we are also encouraging Trading and efficient allocation of risk across financial instruments and markets. Without market makers, many products would be illiquid, meaning few to no opportunities to buy or sell a product of interest exists.

How does Trading combine with Technology?

We make trades at breakneck speeds and on vast scales. Trading like this is only possible through advanced, custom-built technology.

Let’s start with speed. Trading requires us to be very fast. By developing algorithms that can identify and act on the trades we want, we’re able to respond to these opportunities before our competitors do. The technology our Traders focus on the most is our automated trading systems. These systems use our internal settings (or parameters) and live market information to determine and output orders that we would like to trade.

Then there’s scale. Technology can amplify our ability to trade more financial products and perform more trades without increasing the need for more traders. It saves our traders time so that they can focus on other things like discussing potential improvements and testing and deploying solutions. Technology also has higher data processing capacities over humans. So we utilise data and analysis systems that allow us to be very scientific and precise with our strategies. We also use software and hardware to manage our trading risk.

Technology is such a core component of our business that we have roughly 1.5 people in the Technology team for every Trader.

There are lots of things that make Optiver a great place to work. We’ve built a fantastic culture that helps our people do the best work of their lives. We’ve harnessed the power of an amazing tech team, that solves challenging problems every day. We’re so proud of our world, we’ve even made some videos to show you who we are, what we care about, and how we work together. If this sounds like the kind of place you’d thrive, why not join us?