Mass cancellations and purge ports

In a series of articles, we’re exploring liquidity protection – the measures offered by exchanges to ensure that market makers are able to quote without taking excessive risk. Effective liquidity protection is, in our view, fundamental for facilitating price discovery in liquid, electronic options markets.

Mass cancellation messages, especially when used in combination with purge ports, are one of the simplest and most effective forms of liquidity protection. Easy to implement, they do not significantly alter market dynamics or overly complicate the market structure. That makes them a useful alternative to programs such as asymmetric speed bumps, which can be more complex for exchanges to adopt and aren’t always suitable in a given market or context.

What are mass cancellation messages?

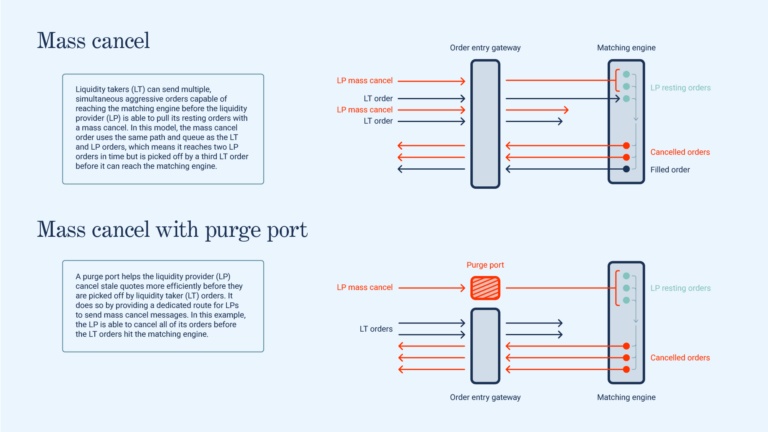

In the simplest terms, mass cancellation messages (also called bulk order delete messages) provide market makers with the ability to delete multiple quotes with a single message. Liquidity takers can target quotes from liquidity providers via multiple paths with limited risk of failure. Forcing liquidity providers to send individual cancellation messages for potentially thousands of instruments puts them at risk of adverse selection. Market makers may be forced to correct for this by curtailing liquidity and widening spreads. In response, many options exchanges already offer some form of mass cancellation mechanism.

What are purge ports?

Purge ports provide a dedicated path to the matching engine for cancellation messages, allowing them to avoid delays during busy periods. Purge ports route only cancellation messages, which means they have no impact on the handling of non-cancellation messages. This makes purge ports simpler and more straightforward to implement than speed bumps. When used in combination with purge ports, mass cancellations become a powerful liquidity protection tool.

Our recommendations

While many exchanges already support mass cancellation messages, there are a few improvements we’d like to see. First, liquidity providers should be able to decide on the scope of their messages. In other words, they should be able to determine which products and sessions the mass cancellation message applies to. This is preferable to limiting market makers to a product group decided by the exchange.

Second, at many exchanges mass cancellation messages still sit in a queue behind regular orders, despite their time sensitivity. This largely defeats their purpose. Purge ports represent a solution to this.

Taken together, mass cancellation messages and purge ports can go a long way toward protecting options liquidity, with a minimum of added complexity or distractions.

Read next: The verdict is in for Eurex’s passive liquidity protection

To discuss this paper – or any other market structure topic – reach out to the Optiver Corporate Strategy team at [email protected]

DISCLAIMER: Optiver V.O.F. or “Optiver” is a market maker licensed by the Dutch authority for the financial markets to conduct the investment activity of dealing on own account. This communication and all information contained herein does not constitute investment advice, investment research, financial analysis, or constitute any activity other than dealing on own account.