Equity options: Who uses them and why?

This is the second in a series of articles exploring single-stock options across Asia Pacific (APAC) markets. To read the first instalment, click here.

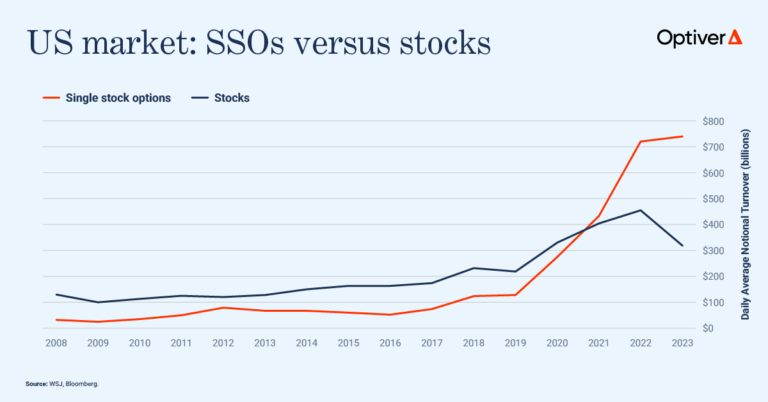

Equity options present tremendous growth opportunities for APAC markets – if only because they are one of the fastest-growing products in the world. In 2021, the daily average notional value of traded single-stock options (SSO) in the US surpassed that of stocks for the first time and has remained significantly higher ever since.

Let’s investigate what makes SSOs such a popular product in so many markets. (To review the basics of options read our explainers here.)

Broadly speaking, SSOs can be used by investors of all types for risk management and income generation. Their flexibility and ability to provide leverage in a cost-efficient way makes them ideal for these uses.

SSOs have increased in popularity since 2019 at least in part because of the unpredictable macro environment. Events such as the Covid-19 pandemic, the Russia-Ukraine conflict and trade and supply chain shocks, have generated a period of sustained volatility in markets. Derivatives come into their own whenever investors seek ways to hedge their portfolios. Investors also employed SSOs as an alternative source of yield, particularly in countries experiencing periods of sustained low interest rates.

Beyond these factors, access for investors in many regions of the world has improved, making SSOs easier to trade. Concurrently, we have seen huge leaps of innovation in trading apps and tools that allow investors to learn about how to use and trade SSOs.

Investor use cases

SSOs provide investors with more flexibility than stocks by enabling them to position themselves for upward or downward movements in the underlying, or even in the volatility of the stock.

The most common uses of SSOs for investors are for risk management or hedging purposes and to generate income from their stock holdings. We explore how these work in practice in greater detail below.

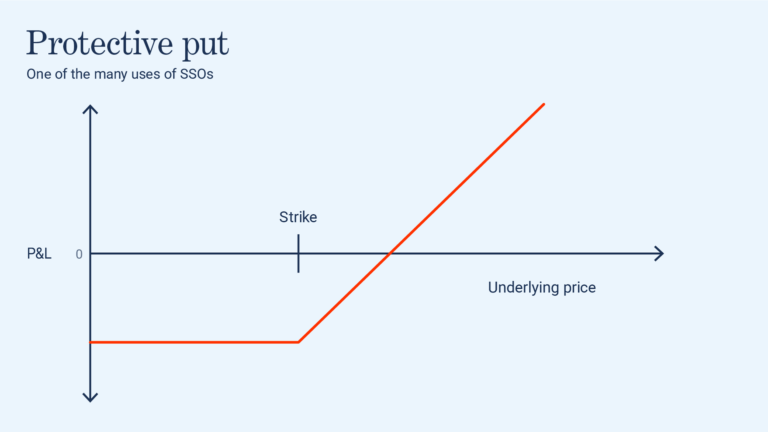

Protection from downside risk using a long put (protective put)

Suppose an investor owned a stock trading at $100 and wanted protection over the next year to cap any potential losses at 10% of the current stock price. The investor could purchase a 1-year 10% downside put option giving them the right (but not the obligation) to sell their stock at a price of $90 any time over the next year.

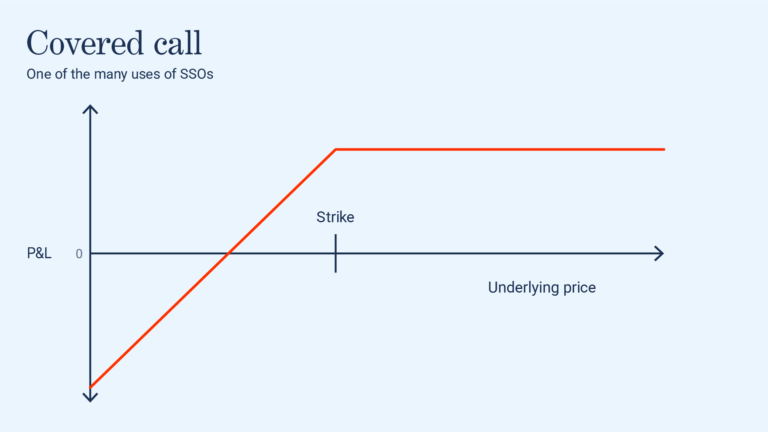

Generating additional income from existing investments using a covered call

A covered call is constructed by combining a long position in the underlying stock with writing a call option against the same stock. For example, suppose an investor owns a stock trading at $100 and doesn’t expect the stock to change much in value in the next 6 months, yet they would like to earn extra income from this investment. They could sell a 6-month, 10% upside call option, for which they receive an option premium. This position generates income for the investor when the underlying asset moves less than the amount of the premium. It also offsets any losses on the stock position if it falls. In return, the investor caps the profit potential by agreeing to sell the stock at the strike price. This strategy works well if the investor expects little change in the price of the underlying asset or has determined an exit level for their investment at which they are happy to sell.

Exchanges

For exchanges, SSOs can add depth to an overall derivatives product offering and provide synergies to boost existing equity derivatives products. A typical derivatives exchange will usually offer the following suite of equity related products, of which SSOs form a key part:

- Equity index futures and options

- Equity futures (SSFs) and options (SSOs)

- Equity and equity index warrants

All these products are interlinked and allow participants to create strategies to trade each product against or alongside one another.

Exchanges often work closely with market makers or liquidity providers to ensure these products are liquid in terms of market spreads, size and continuous quoting. This provides investors with the confidence to be able to trade in and out of positions in a fair, transparent and competitive way.

Equity derivative offerings at some APAC exchanges are more developed than others, leaving plenty of opportunity for other exchanges to build out their offerings.

| Product | India | Hong Kong | Japan | Korea | China Mainland | Taiwan |

| Index futures | Listed | Listed | Listed | Listed | Listed | Listed |

| Index options | Listed | Listed | Listed | Listed | Listed | Listed |

| Equity futures (SSFs) | Listed | Listed | Not Listed | Listed | Not Listed | Listed |

| Equity options (SSOs) | Listed (very popular) | Listed (very popular) | Listed (room for growth) | Listed (room for growth) | Listed (ETF options) | Listed (room for growth) |

| Equity warrants | Listed (minimal) | Listed | Not Listed | Listed | Not Listed | Listed |

| Equity index warrants | Not Listed | Listed | Not Listed | Listed | Not Listed | Listed |

| India: NSE and BSE Hong Kong: HKEX Japan: OSE Korea: KRX China Mainland: SSE and SZSE Taiwan: TAIFEX and TWSE | ||||||

To discuss this paper – or any other market structure topic – reach out to the Optiver APAC Corporate Strategy team at [email protected]

DISCLAIMER: Each of Optiver Australia Pty Limited ABN 54 077 364 366 AFSL 244145, Optiver Trading Hong Kong Limited APO583, Optiver Taiwan Futures Co., Ltd F034, Optiver Singapore Trading Pte Ltd UEN 202107169R and Optiver (Shanghai) Trading Company Limited (individually and collectively, “Optiver”) is a proprietary trading firm and trades exclusively for the benefit of its own account or its’ affiliates. This communication is for informational purposes only. It is not a recommendation to engage in investment activities and must not be relied upon when making any investment decisions. This communication does not consider the investment objectives or financial situation of any particular counterparty. All investments involve risk and no portion of this document should be interpreted as legal, financial, tax, or accounting advice, and should not be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap, or other derivative or financial instrument. Entering into transactions with Optiver does not create or represent a customer relationship for either party. As such, none of the regulatory provisions regarding customers will apply to the transactions Optiver enters into with you. There are no warranties, expressed or implied, as to the accuracy or completeness of any information provided herein. The sources for the information and any opinions in this communication are believed to be reliable, but Optiver does not warrant or guarantee the accuracy of such information or opinions.