Strengthening the capital rules at Taiwan Futures Exchange

To determine the amount of margin and capital that market participants may use to trade options and futures, the Taiwan Futures Exchange (TAIFEX) uses an adjusted net capital (ANC) ratio. Haircuts in the ANC formula can mis-characterize certain options positions, however. In this paper, we weigh up TAIFEX’s capital rules and suggest fixes to make them more effective.

Capital rules are designed to ensure that market participants maintain sufficient capital to cover their trading risks. While specifics vary across jurisdictions, most formulas compare the amount of margin deployed by a market participant against its net capital. Net capital is typically computed by subtracting a market participant’s current liabilities from its current assets.

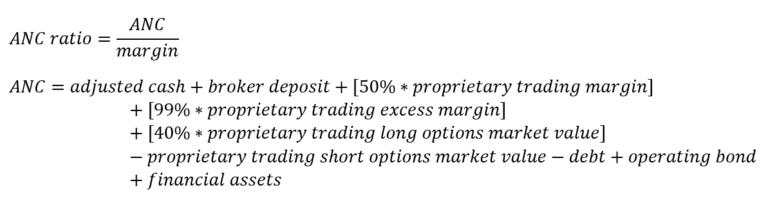

The Taiwan Futures Exchange (TAIFEX) adapted its capital rules from the US several decades ago in the form of an adjusted net capital (ANC) ratio. To calculate the ANC ratio, authorities divide a market participant’s ANC by the amount of margin used. Calculating the ANC requires subtracting all liabilities from adjusted current assets.

It’s critical that any capital rules designed to protect investors don’t end up doing more harm than good. Well-meaning rules can lead to unintended consequences by making it more difficult for investors to transact during volatility, for instance.

As we’ll demonstrate below, haircuts applied to certain elements in the ANC formula can have exactly this effect. We suggest authorities scrap these haircuts. This would provide a more accurate reflection of the risks of a portfolio, and offer better protection to investors as a result.

Formulas

Long options example

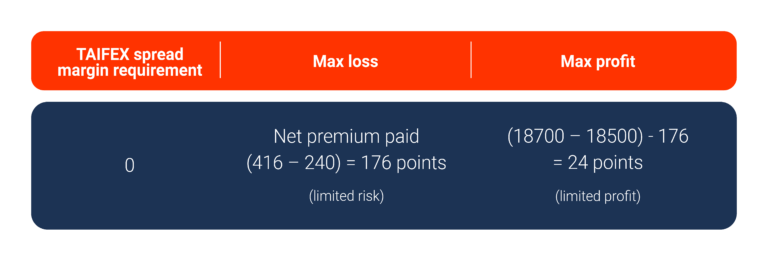

The shortcomings of the ANC formula are easy to see when considering certain options spreads commonly held by market participants. Take the bear put spread, for example. One of the features of this spread – where market participants sell low-strike puts and simultaneously buy higher-strike puts – is that it limits the maximum loss of the position to the net capital spent. Consider the following example:

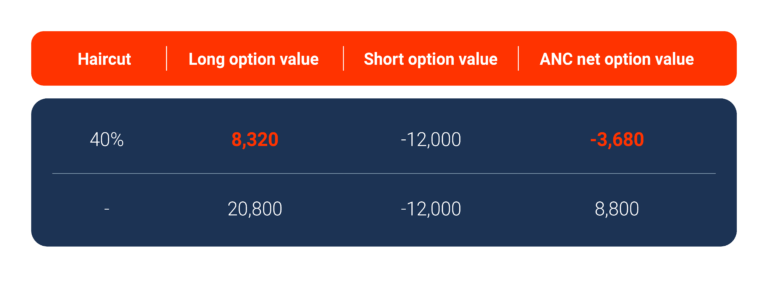

The net value of the spread shown in the table above is positive (8,800) thanks to its limited risk. Because the risk (as well as the potential profit) is limited, under the TAIFEX spread margin rule, the margin requirement for such a position would be zero:

But look what happens when we apply the ANC formula to this position. As the table below shows, applying the 40% haircut slashes the value of the position to -3,680.

The result is that the spread goes from being a positive asset to a negative asset. What’s worse, the problem is exacerbated in a falling market. As markets decline, the rising put premium makes the value of the spread even more deeply negative, widening the gap to its true value. This can lead to the absurd outcome of forcing the market participant to liquidate the position even though it remains a profitable one. Not only does the ANC formula fail to value this position accurately, it can actively discourage market participants from building these types of risk-limited spreads.

SPAN margin example

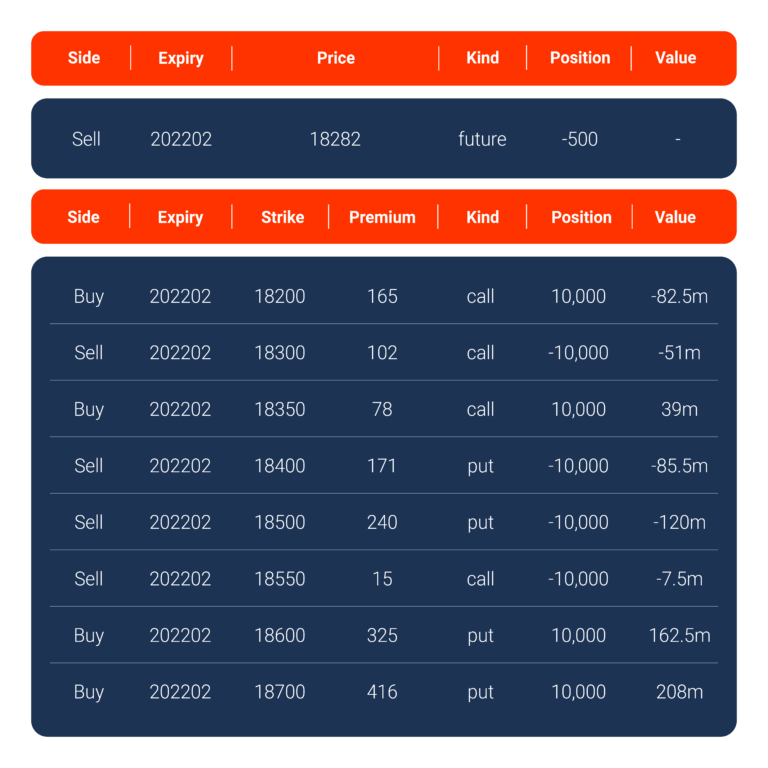

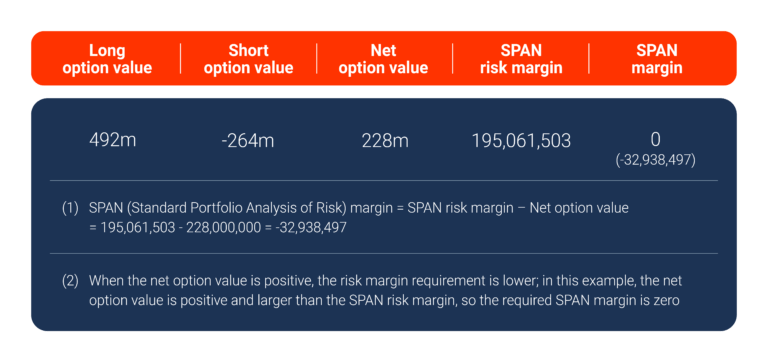

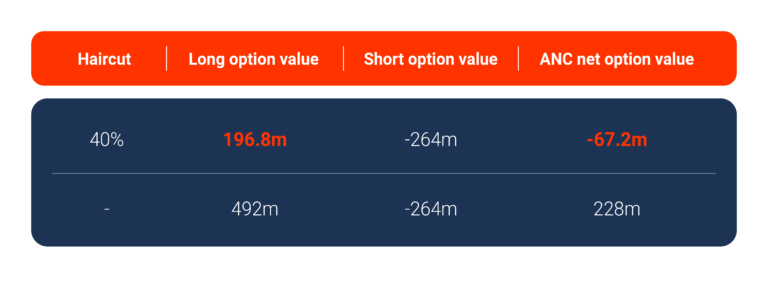

Another way to demonstrate the flaws in the ANC formula is by comparing it with the calculation of the SPAN (Standard Portfolio Analysis of Risk) margin. The SPAN margin is a globally-accepted standard that measures the risk of a portfolio by determining the amount of margin that should be posted to cover potential losses. Consider the portfolio of options and futures below:

For this portfolio, we get a required SPAN margin of zero, indicating that the risks of the portfolio are offset. When the net option value is higher than the SPAN risk margin, which is the case above, no SPAN margin is required:

Now look what happens when we apply the 40% haircut. Once more, it turns the net option value from positive to negative. In other words, the ANC isn’t accurately reflecting the risk of the portfolio.

Proprietary trading margin example

Another shortcoming in the ANC formula is the 50% haircut applied to the proprietary trading margin. TAIFEX uses a “fully paid pre-margin” system to protect against risks. This is sufficient to cover the risks of market participants’ positions because a broker or clearing member can collect this margin when their client sends an order. However, by applying a 50% haircut to this margin, authorities are effectively doublecounting the risk. We’re also hard-pressed to find the rationale for imposing a 50% haircut on margin in any study or research report we have consulted.

Conclusion

The ANC ratio, like all capital rules, should protect investors from excessive leverage while preserving their ability to transact during volatility. However, in the case of the ANC ratio at TAIFEX, it isn’t difficult to imagine the vicious cycle that could unfold as a result of its flawed methodology.

Picture a falling market. Market participants looking to buy back short options positions could find dealers reluctant to sell too many options because they’re concerned with maintaining a healthy ANC ratio. This would lead to higher demand for a dwindling pool of options, driving up prices for these contracts, which in turn would increase these dealers’ short positions, compelling them to buy back more options in order to increase their ANC ratio. This vicious cycle could continue until all under-capitalized short positions are liquidated or well-capitalized sellers come into the market.

Such an outcome could be avoided by scrapping the 40% and 50% haircuts. Though TAIFEX adapted its ANC ratio from the US, the latter has long since reformed it. Singapore has phased it out completely, opting for a liquidity risk-based approach instead. The changes outlined in this paper would be a small but significant step toward modernizing TAIFEX’s capital rules.

To discuss this paper – or any other market structure topic – reach out to the Optiver APAC Corporate Strategy team at [email protected]

DISCLAIMER: Each of Optiver Australia Pty Limited ABN 54 077 364 366 AFSL 244145, Optiver Trading Hong Kong Limited APO583, Optiver Taiwan Futures Co., Ltd F034, Optiver Singapore Trading Pte Ltd UEN 202107169R and Optiver (Shanghai) Trading Company Limited (individually and collectively, “Optiver”) is a proprietary trading firm and trades exclusively for the benefit of its own account or its’ affiliates. This communication is for informational purposes only. It is not a recommendation to engage in investment activities and must not be relied upon when making any investment decisions. This communication does not consider the investment objectives or financial situation of any particular counterparty. All investments involve risk and no portion of this document should be interpreted as legal, financial, tax, or accounting advice, and should not be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap, or other derivative or financial instrument. Entering into transactions with Optiver does not create or represent a customer relationship for either party. As such, none of the regulatory provisions regarding customers will apply to the transactions Optiver enters into with you. There are no warranties, expressed or implied, as to the accuracy or completeness of any information provided herein. The sources for the information and any opinions in this communication are believed to be reliable, but Optiver does not warrant or guarantee the accuracy of such information or opinions.