Not just PFOF: Another anti-competitive threat to European markets

Payment for order flow is starting to attract real attention, but we think there’s a more insidious threat to retail investors out there. It’s the preferential market-making arrangements prevalent in countries like Germany. We encourage authorities to act now to rein in these practices.

Leveling the playing field for retail investors is an issue that’s finally starting to galvanize European lawmakers. Authorities have recently turned their attention to regulating payment-for-order-flow (PFOF), with European lawmakers debating ways to limit or ban the practice as part of the Markets in Financial Instruments Regulation (MiFIR).

But for all the attention being paid to PFOF, there’s a more insidious threat to investor fairness that’s not getting nearly as much airtime as it should.

We’re referring to the preferential market-making arrangements found throughout Europe but that are particularly prevalent in Germany. While PFOF can pose conflicts of interest, retail trading models in countries like Germany – which we highlighted in a January 2022 paper – are far more concerning. Regulators should act now to rein in these practices.

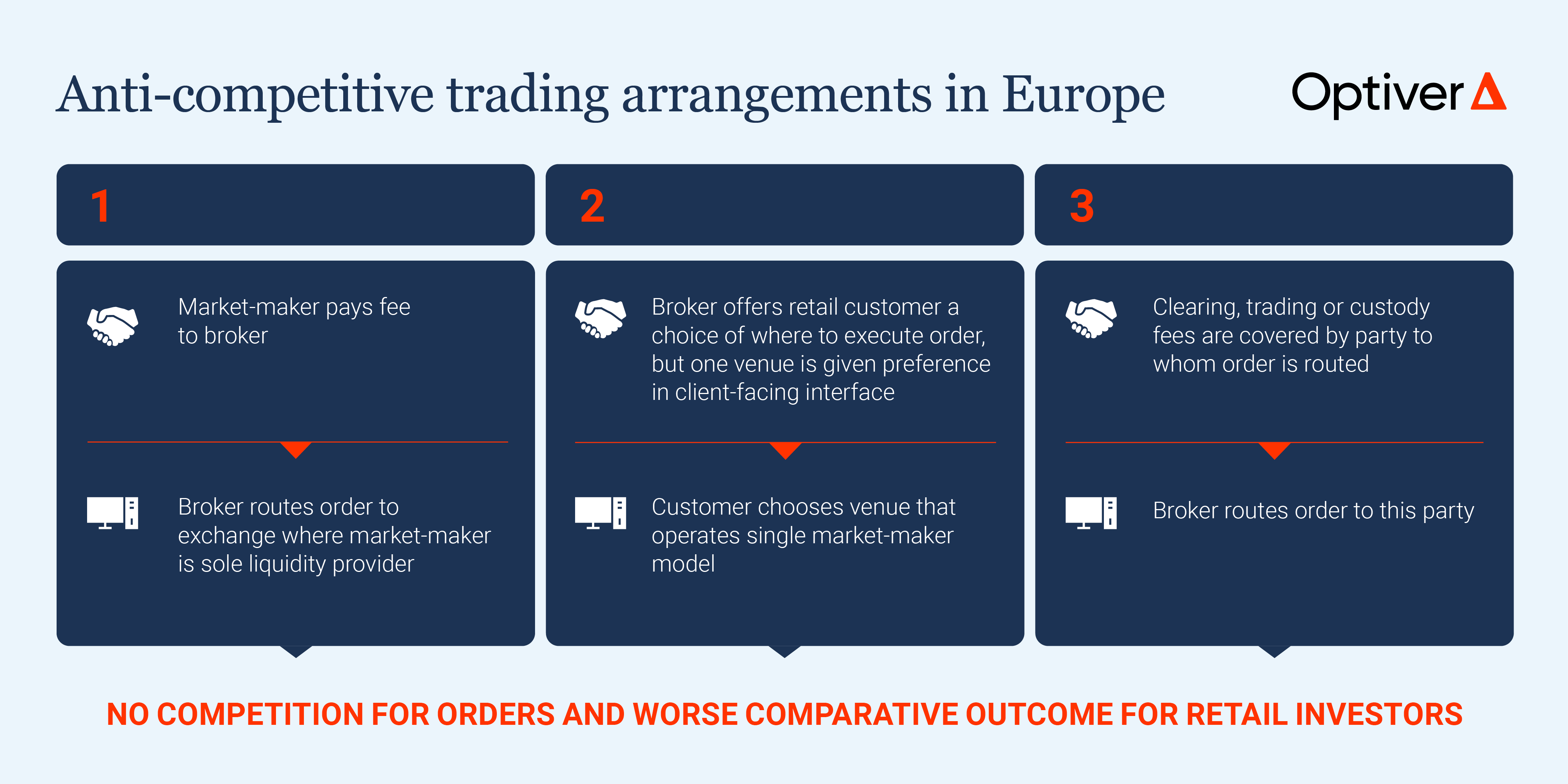

The way this model works is that retail brokers send all or most of their customer orders to trading venues with one market-maker per instrument or product class. In return, the market-maker, often affiliated with the exchange, pays a per-order fee to the retail brokers.

To understand how these arrangements rose to prominence, it helps to go back to early 2020, when pandemic lockdowns were fueling waves of activity from retail investors. Alongside the rise of retail trading was a contemporaneous boom in trading apps giving easier and cheaper access to markets.

Some of these new entrants use PFOF as a way to supplement revenues. In the US, PFOF represents a large chunk of these brokers’ income. In countries like Germany, that revenue flows to brokers via the arrangements described above.

Restricting access

The venues in question are regulated as multilateral exchanges but have rulebooks and policies that effectively restrict access to competing liquidity providers. One of the largest German retail venues, for example, prohibits non-specialists from deploying algorithmic or market-making strategies.

In our view, the result is a market that behaves less like a multilateral exchange and more like a systematic internaliser (primarily used by banks to transact proprietary liquidity against client orders). These single market-maker venues also use a slimmed-down settlement process, which strips out a chunk of post-trade costs.

Taken together, it’s easy to see why these features make single market-maker venues a compelling commercial proposition for retail brokers. But the inherent conflicts in these models mean retail customers may be routing to venues that maximise their profits rather than seeking the best possible price for their orders.

A February 2022 study from the Dutch AFM showed that one venue relying on a single market maker model delivered worse prices more than 70% of the time when compared with the listing market.

Missed opportunity

To date, EU regulators have largely declined to address these models. The European Securities and Markets Authority failed to consider the structure of single market maker exchanges in its recent trading-venue perimeter investigation. Meanwhile, the MiFIR review is currently pursuing a narrow focus on US-style PFOF.

The MiFIR text agreed by the Council of the European Union in December does not address the single market-maker model and allows member states to permit PFOF for domestic customer orders.

The onus now lies with the European Parliament, which also has a say in the final MiFIR text. Despite some initial encouragement, MEPs appear unlikely to ban brokers from having preferential intermediary relationships.

To us, that’s a missed opportunity. While EU regulatory negotiations are notoriously fraught, the MiFIR review provides a window for tackling these problematic arrangements to ensure safeguards are put in place to foster competition and provide better outcomes for individual investors.

Further reading

- Our paper on stimulating retail investor activity in Europe.

- We looked at some retail trading models in the region that are working.

- The Dutch AFM study on execution quality in trading venues.

- Our deep dive on PFOF in the US options market.

To discuss this paper – or any other market structure topic – reach out to the Optiver Corporate Strategy team at [email protected]

DISCLAIMER: Optiver V.O.F. or “Optiver” is a market maker licensed by the Dutch authority for the financial markets to conduct the investment activity of dealing on own account. This communication and all information contained herein does not constitute investment advice, investment research, financial analysis, or constitute any activity other than dealing on own account.