The market players doing retail trading right

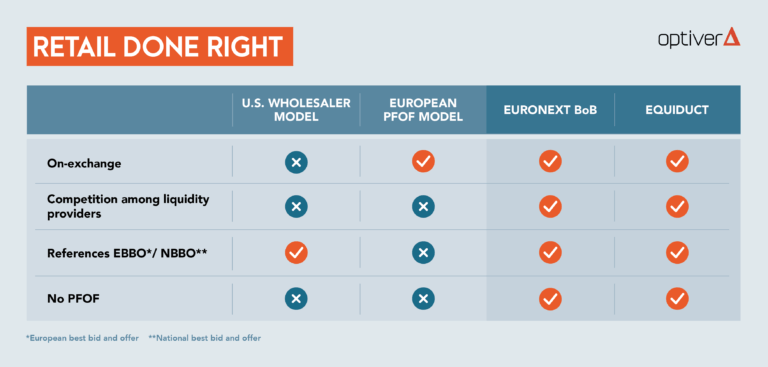

The already-heated debate around payment-for-order-flow (PFOF) has only intensified amid Europe’s retail trading boom. Neo-brokers continue to argue that PFOF is the only way for smaller investors to enjoy zero-fee trading. We disagree. A zero-cost trading model where liquidity providers compete for orders is not only possible – it’s already here.

No one at Optiver was particularly shocked by the Dutch markets regulator’s recent findings that payment-for-order-flow (PFOF) is usually a lousy deal for investors. In a study that looked at trading across three platforms, the AFM found that between 70% and 85% of the time customers paid more at single market-maker venues with little competition for order flow compared with other platforms. The results merely support our view that lack of true competition leads to poorer outcomes for investors.

The Dutch study is just the latest data point in an ongoing debate that’s been fanned by the historic boom in retail investing across Europe. In France, the number of stock market transactions by smaller investors surged during the first months of the pandemic. They’ve remained elevated ever since. Retail-focused exchange Equiduct saw average daily volumes increase by 88% in 2020 from a year earlier.

Neo-brokers like Trade Republic and Robinhood argue that PFOF is the only way investors can continue to enjoy zero-fee trading. We don’t see it that way. In fact, we think a zero-cost trading model where liquidity providers compete to execute orders is eminently possible. Not only is it possible, but it’s already here.

For instance, Euronext’s Best of Book operates a retail-facing model that encourages healthy competition among market makers for order flow. Equiduct enables zero-fee trading while promoting competition in a way that’s equally commendable. Both venues are competitive, innovative and transparent, and we highlight them here as examples of parties that are facilitating retail investing the right way.

Euronext’s best of book (BoB)

One model that focuses on retail investors without resorting to problematic arrangements like PFOF is Euronext’s Best of Book (BoB). BoB was designed to help retail-facing brokers meet their best execution requirements and generate price improvement for their clients while routing orders to a single trading venue. The model works by flagging incoming retail orders and making them eligible for improved quotes on the exchange’s central limit order book (CLOB), where multiple liquidity providers compete to fill them. Clear evidence exists that this arrangement leads to price improvement for investors.

Both market makers and brokers pay fees to Euronext in order to use BoB. While we applaud most aspects of the BoB model, this is one feature we ultimately find difficult to support. In line with our belief that zero-fee trading is here to stay, we question whether a model that charges fees to brokerages, which are then often passed on in one form or another to customers, is the way forward.

Equiduct’s APEX

Another model operating in Europe is Equiduct’s Apex best execution service. Equiduct1 is a fully regulated, retail-focused exchange that offers trading in pan-European equities and exchange-traded funds (ETFs). Like BoB, the Apex model flags retail orders, making them eligible for improved quotes.

That’s where the similarities end however. Whereas market makers on BoB compete for retail orders through price improvement, the exchange sets prices on Apex. In particular, liquidity providers are required to execute retail trades at the European Volume-Weighted Best Bid or Offer (VBBO). The VBBO is essentially a consolidated order book that aggregates quotes from national exchanges and multi-lateral trading facilities across Europe. VBBO aims to ensure that brokers meet their best execution requirements by trading against the best price displayed across Europe at a given volume. Liquidity providers compete on the basis of size, coverage offered and potential price improvement.

Unlike BoB, retail brokers are not charged execution fees on Apex. We feel this is a strong point of the platform. Like the U.S. wholesaler and German regional exchange models, it doesn’t charge brokers. And like BoB, it supports multi-lateral, pan-European trading.

1 Optiver holds a minority stake in Equiduct.

Market segments and trading hours

We’ve previously argued that turning Europe into a truly global center for equity financing and secondary trading requires extending market hours and geographical segments. We applaud exchanges like Xetra and Borsa Italiana that offer trading in U.S. stocks during European hours. Turquoise, majority owned by the London Stock Exchange Group together with its users, recently made it possible for investors to trade U.S. stocks during U.K. hours with fungible DTC settlement. The popularity of American shares among retail investors is well-known, and venues that offer this segment are pointing the way forward for others. Another way of catering to retail investors is by extending trading hours. Many smaller investors who wish to trade actively turn to competing products like FX, commodities, cryptocurrencies and structured products that trade with longer hours. In response, some exchanges now offer extended trading. For example, Borsa Italiana offers a retail-focused after-hours segment, while regional German exchanges open earlier and close later than traditional European equities exchanges.

Conclusion

It’s clear from a cursory glance around that retail-friendly trading models that promote competition for order flow are not only possible, but are already here. When it comes to trading venues, we favor an approach that designates a retail segment on the exchange, with a leadership team that includes stakeholders and users, and is regulated and governed by a rule book and regulators. We’ve invested in a number of companies, including Equiduct, that are finding ways to appeal to the growing segment of smaller investors. Only by supporting these players will we help build a transparent, regulated, competitive and innovative trading ecosystem that keeps retail investors investing.

Further reading

- The AFM’s study about PFOF venues.

- An article about Turquoise expanding its U.S. stock trading segment.

- Our recommendations for improving retail investor outcomes.

- Our arguments for expanding European trading hours.

Optiver supports open discussion and debate on all market structure topics that would lead to an improvement of the market.

To discuss this paper – or any other market structure topic – reach out to the Optiver Corporate Strategy team at AMS_CorporateStrategy

DISCLAIMER: Optiver V.O.F. or “Optiver” is a market maker licensed by the Dutch authority for the financial markets to conduct the investment activity of dealing on own account. This communication and all information contained herein does not constitute investment advice, investment research, financial analysis, or constitute any activity other than dealing on own account.