The internship journey to becoming a Trader

Jeremy was propelled into the world of trading when he got into the Optiver trading internship in his final year of university at the University of Queensland. With a degree in Advanced Finance and Economics, he now works as a graduate trader at Optiver Sydney. On the weekends, he enjoys trail running and football, and has recently started playing table tennis during his lunch breaks.

What made you choose a career in trading?

I have always been interested in trading – share trading games with my dad, trading player cards on FIFA and that sort of thing got me interested at a young age. It got a bit more serious in university with UQ’s student managed investment fund and my own cryptocurrency trading. I love the market making we do at Optiver as there are so many factors to consider in keeping pricing accurate and there are so many interesting directions a problem can take. I also love the new dimensions that options provide to markets, where views can be expressed on not just the direction, but also the magnitude, timing, speed and path.

How did the internship at Optiver help you in your current role as a graduate trader?

In so many ways! Everything I learnt in the internship is applicable in the graduate role. I also met people that I now work with and got used to the team dynamic and fun loving yet high-performance culture at Optiver.

Tell us a bit about the internship experience.

At times I found it very challenging, at other times I was more comfortable and familiar with the content, but I never lost interest or stopped learning. There was a great balance between classroom-style learning and practical trading simulations and projects that provided a lot of satisfaction when the theory we’d been studying came into effect.

What is a day in the life of a trader like?

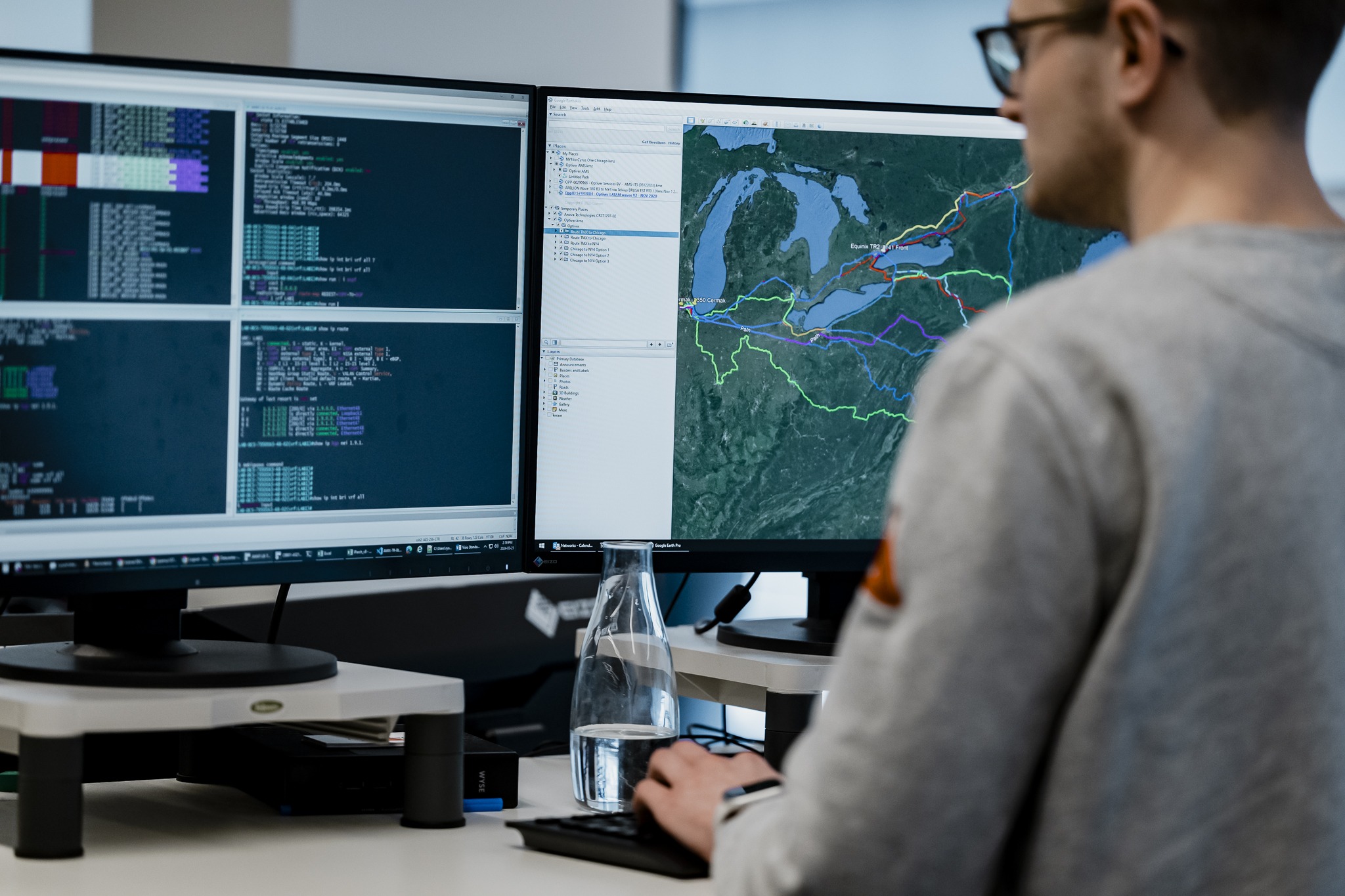

In trading, truly no day is the same. My weetbix brekkie on level 7 however is my only morning guarantee. By then I would’ve already caught up on the news in preparation for the morning meeting where we discuss how we expect the market to behave at open. We then set up our screens and prepare for trading. From market open everything happens quickly but if it quiets down then we can spend some time working on visualisation, tools and research that improve our trading decisions. This may continue a bit after market close, when we also write up a reflection on the day’s trading.

What advice would you give to applicants for trading roles at Optiver?

It is best to focus on your strengths and work on that something that you may one day be THE BEST at. Love that and hone it. Be confident and convicted in your opinions when you have one, or humble and open when you don’t. Finally, a light hearted and good sense of humour can go a long way.

What skills do you need to be a trader?

No trader is the same and we each bring unique skills to the table but I’d say the following is important for all traders:

- Ability to quickly filter lots of information to get the signal from the noise.

- A desire for genuine understanding of difficult concepts. It’s easy to have a surface level understanding and leaving it at that but going deeper makes a world of difference.

- Always being self-reflective and seeking constructive feedback from others.

What do you enjoy about working at Optiver?

If I have an idea, everyone wants to hear me out and ask more questions. I enjoy that I can discuss these ideas with bright people and see us all understand more together than we could’ve hoped to individually. I also enjoy the direct feedback the market provides and seeing my improvements in understanding directly translate to trading performance.