Inside Optiver’s 12-week training programme

Meet Ophelia, an Execution Trader who joined Optiver after graduating from the University of Cambridge. Despite having no background in finance or trading, Ophelia was drawn to the fast-paced environment and the opportunity to utilise her quantitative skills. In this interview, she reflects on her experience in the Optiver Academy training programme, shares her favourite part of the programme, and offers advice for graduates looking to start a career in trading. Read on to learn more about Ophelia’s journey and how the Optiver Academy can kickstart your trading career.

Meet Ophelia

Hometown: NYC

Hobbies: Yoga, HIIT

Study background: Information Engineering, Cambridge

Do you have a background in trading or finance? / What was your background before joining Optiver?

No – my academic background wasn’t in finance or trading. I studied Information Engineering at the University of Cambridge, which meant I studied different STEM subjects, from Machine Learning to Mathematics.

What lead you apply to be a trader at Optiver?

While I was still at Cambridge, I knew I wanted to work in a fast-paced environment where I could utilise my quantitative skills while not always behind a screen. When Optiver visited for a campus event, I started to read more about the graduate opportunities, and that’s where I came across the Execution Trader role.

I hadn’t heard of the title before, but it seemed to strike the perfect balance between building relationships and onscreen trading. So after graduating, I decided to apply for the position.

Can you tell us about how the programme was structured?

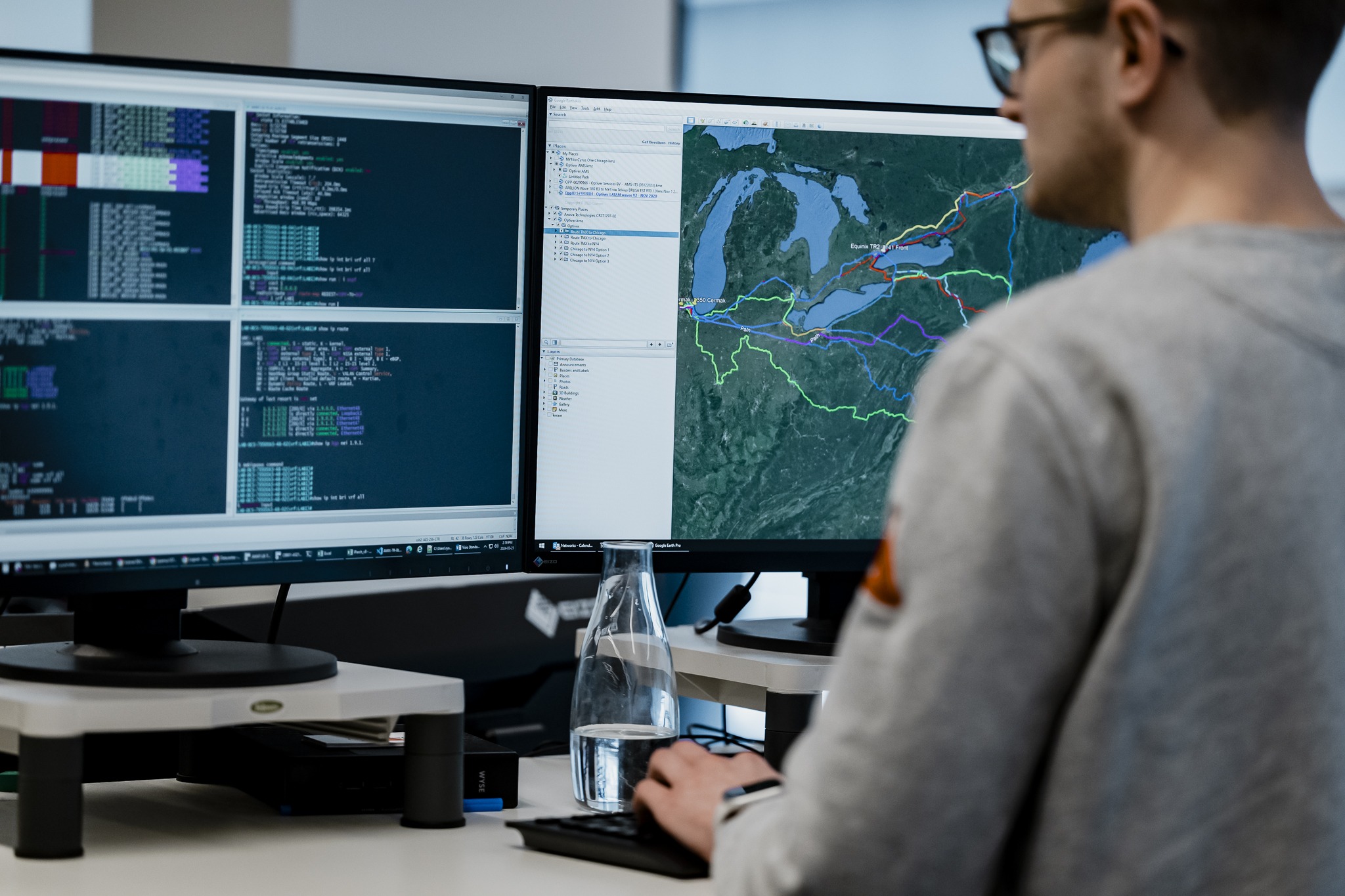

The education and recruitment teams put together 12 weeks of training, which is a really impressive introduction to the firm. In the first four weeks of the programme, I met new traders from all over the world – Chicago, Sydney, Taiwan and London. Together we studied the fundamentals of options theory and how the business operates on a holistic level. I liked that we could all learn from each other.

After that, we moved back to our local offices and started six weeks of simulation trading.

This involved a combination of putting what we learned into practice and getting used to how these theories apply in real-world trading. Volatility, for example, might just a number but it’s important to understand in order to make decisions based on its changes. It was a great way to gain insight into risk management without the need to invest actual money.

The next step was two weeks of working on Delta One projects, where the aim was to bring in new perspectives and ideas, as we all came from diverse STEM backgrounds. After that, we returned to simulated trading in teams.

What was your favourite part of the programme?

The best part for me was how much confidence it gave me to start trading.

It’s very fast-paced, and there’s a steep learning curve, especially as you’re also joining alongside previous interns who already have some level of knowledge about the theory and the business. It can be overwhelming in the beginning, but by the end of the first four weeks, everyone is on the same level and ready to take on the next part of the training.

What was it like transitioning from training to your trading desk?

After completing sim trading, I was put on the index trainee spot where I started trading with real capital but with small risk limits. This was the perfect opportunity to apply the knowledge I learned during the sim trading and develop a better understanding of market making.

When I moved to the main trading desk, I quickly realized that the competition was much higher, and the risk limits were much larger. It was no longer a scenario where a ten lot order was up for grabs by anyone. I had to actively think about how to trade and the timing of my trades, given the faster systems and increased risk levels of the main desk. It was challenging, but the 12-week training really prepared me for what was to come.

Do you have advice for graduates looking to start a career in trading at Optiver?

I think it’s a great place to start your first job. It’s very stimulating and there’s always new challenges. The team is young, so it’s very easy to talk to other traders on the floor and offer your contribution to discussions. We also have a flat culture, so you’re encouraged to ask questions to your colleagues.

Are you ready to launch your trading career and join the Optiver Academy? Apply to our graduate positions and you could join our next training programme!

Watch the video to learn more about the Optiver Academy Program.