Volatility investing in 2021

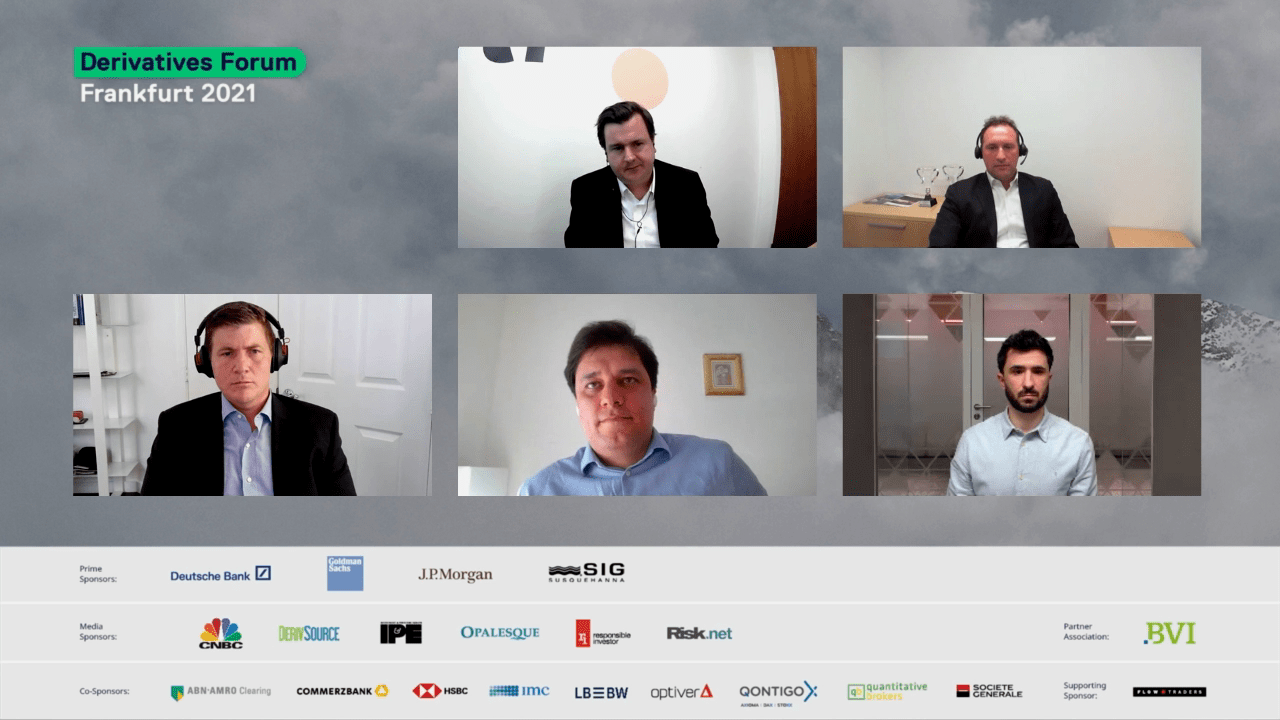

Retail participation has been a dominant theme in US markets this year, with spillover into Asian and European markets. To hear Optiver Europe’s global derivatives trade lead, Alexandros Vlavianos’ views on how this has impacted the volatility landscape, watch the playback of the recent Eurex Derivatives Forum 2021 panel discussion with Mikhail Krayzler, PhD at Allianz and Stefan Wintner from DUNN Capital (Europe) and Yanko Punchev from Tecta Invest, moderated by William Mitting, CEO of Acuiti.io.