EQD research: volatility at tipping point in South Korea

by Russell Rhoads, original content published in EQD,

While retail participation in U.S. derivative products captured headlines thanks to unprecedented government fiscal support, social media enthusiasts and meme stocks; there is one corner of the world where regular investors and day traders are more than familiar with the opportunities that options trading present.

Index options on South Korea’s Kospi 200 are among the world’s most actively traded. Average daily notional turnover in Kospi 200 options hit almost USD280 billion per day in the first two months of 2021, more than nine times the daily options turnover of Japan’s Nikkei 225. Such impressive volumes are thanks in part to a long-standing and potent combination of domestic retail and institutional appetite for leverage, as well as outsized returns accessed either directly via index options or indirectly via warrants, autocallables and other structured products.

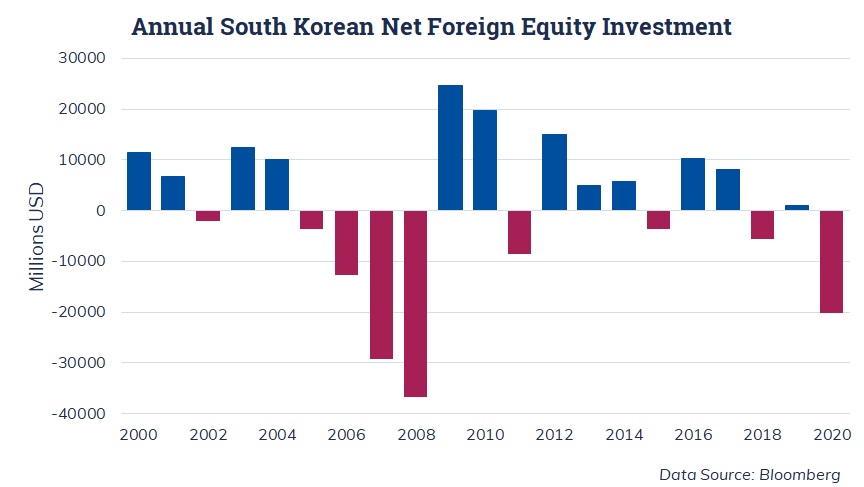

Participation in derivatives markets has also been supported by the underlying index’s relative strength among the Asia Pacific broad-based market indices. In 2020, the Kospi 200 put up gains of just over 28% and this momentum continued into 2021 with the index up as much as 13.4% in mid-January, though year-to-date gains now stand at a more modest 5%. Outperformance was achieved due to retail investors and supported by the pandemic-imposed ban on short-selling which came into effect in March 2020. The extent of local enthusiasm for stocks more than made up for a decline in net foreign equity investment into Korean equities which came in at a negative USD20 billion last year.

Despite their popularity with domestic investors, Kospi 200 options have largely been shunned by institutional traders who have historically expressed their views on regional volatility via Japan’s Nikkei 225 options or more recently Hong Kong’s HSCEI. Similarly, both domestic and international structured product issuers have tended to favor these underlyings to form part of their worst-of-baskets alongside the likes of the Standard & Poor’s 500 and Euro Stoxx 50.

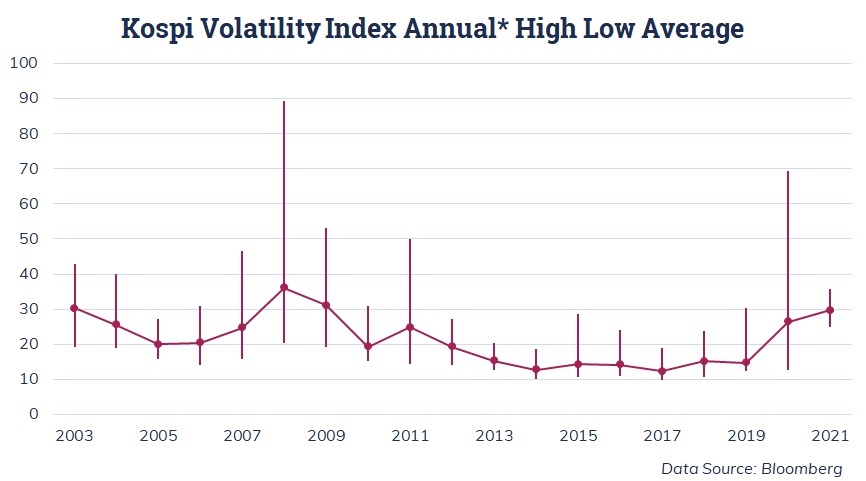

However, in 2020, both expected and realized volatility on the Kopsi 200 outperformed relative to historical levels. The Kospi Volatility Index averaged just over 26 in 2020, the highest average for 30-day expected volatility since the financial crisis. Similarly, in the first two months of 2021 the average daily close is just under 29.

Stéphane Martin, head of institutional trading APAC for Optiver, notes that there is “a significant uptick in institutional participation in Kospi 200 options,” adding that “retail exuberance in both cash and derivatives markets throughout Q4 and in the first two months of 2021 contributed to a sustained period of materially higher short-term implied volatility, attracting non-domestic institutions looking to capitalize on both outright and relative-value volatility opportunities.”

Like many global equity markets, the Kospi 200 and expected Kospi 200 volatility have reached a tipping point and there are strong arguments for a drop as well as a continuation of elevated volatility throughout 2021.

Retail investors are prone to herd mentality. Since the market strength and upside volatility has been driven in part by retail flows, if appetite were to cool off, a drop in realized volatility may accompany this change in investor attitudes. In addition, the outflow trend for foreign equity investment into South Korea last year has continued through the first two months of 2021, again despite the Kospi 200 rising over that same period of time. As of the end of February, South Korean equities have experienced close to an outflow of USD7 billion.

Another key date to bear in mind is May 3 when the short-selling ban is partially lifted for stocks on the benchmark Kospi 200 Index and the small-cap Kosdaq 150.

Persistent elevated levels of Kospi 200 implied volatility may also help increase demand for autocallable products which could in turn result in dealer hedging suppressing implied volatility, especially through longer-dated tenors. Karinvir Gill, senior options trader at Optiver said, “The outright level of Kospi volatility, relative to other common underlyings in structured product portfolios, could make it an attractive alternative considering the enhanced yield available. The trend over the last decade toward the likes of HSCEI has been partially caused by Kospi vols being too low to offer attractive coupons and therefore this trend could reverse in the short term if the vols remain elevated and more product is issued.”

A bullish argument may be made for volatility expectations to remain at elevated levels or even move higher. Fundamentally, about 38% of the weighting in the Kospi 200 is semiconductors stocks, a sector that would be expected to benefit from a global economic recovery.

If foreign investors reverse their attitude about South Korean stocks this could be a catalyst for the next leg up in the Kospi 200. Both bullishness for semiconductor stocks or an influx of foreign capital could spark another round of buying activity from retail investors that are not as price sensitive as professional investors. This could also lead to higher call premiums. “The realized environment is very different to what we’ve seen historically,” said Robert Gasper, an options trader at Optiver. “There have been signs of higher realized, especially relative to traditional pairs such as the Nikkei, and exuberance on upticks last year in June and August. The way the product is trading now is very different to 2019 and the interest and flow dominating the vols is also different.”

As noted, Korean equities are at a crossroads with respect to both performance as well as volatility. Realized volatility has been high for Korean stocks and despite coming from the call side of the option market, has resulted in consistently high implied volatility as priced in by Kospi 200 options. A cross current of factors from a lack of foreign interest in Korean stocks to the expiration of short-selling restrictions will have an impact on both the Kospi 200 and associated volatility. With time, the market will give in to the more dominant factors and either the volatility bulls or volatility bears will reap the rewards.